How Does a Life Insurance Calculator Work?

Free Life Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Leslie Kasperowicz

Farmers CSR for 4 Years

Leslie Kasperowicz holds a BA in Social Sciences from the University of Winnipeg. She spent several years as a Farmers Insurance CSR, gaining a solid understanding of insurance products including home, life, auto, and commercial and working directly with insurance customers to understand their needs. She has since used that knowledge in her more than ten years as a writer, largely in the insur...

Farmers CSR for 4 Years

UPDATED: Dec 4, 2023

It’s all about you. We want to help you make the right life insurance coverage choices.

Advertiser Disclosure: We strive to help you make confident life insurance decisions. Comparison shopping should be easy. We are not affiliated with any one life insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different life insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about life insurance. Our goal is to be an objective, third-party resource for everything life insurance-related. We update our site regularly, and all content is reviewed by life insurance experts.

UPDATED: Dec 4, 2023

It’s all about you. We want to help you make the right life insurance coverage choices.

Advertiser Disclosure: We strive to help you make confident life insurance decisions. Comparison shopping should be easy. We are not affiliated with any one life insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different life insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

When shopping for life insurance coverage, one vital step is to know how much you’re going to need to purchase. This process is much more than taking a guess. Settling on any random number and hoping that it will be enough is the equivalent of gambling with your paycheck, or worse, gambling with your family’s financial security.

Even when you do find out how much life insurance coverage you’re going to need, you will need to determine how much the coverage will cost. Sorting through all of this information on the internet to find an answer to this question can be overwhelming.

Thankfully, figuring out how much life insurance to purchase, and how much it will cost, is not a complicated process when using the right tools. By using an online life insurance calculator, you’ll be able to answer questions such as:

- How much life insurance do I need?

- What type of expenses should life insurance cover?

- How much will my life insurance cost?

- Should I purchase a term insurance or whole life insurance policy?

Life insurance calculators can help you determine the answers to all of the above questions. All you need to do is answer a few simple questions. The calculator will compute your responses to suggest an appropriate amount of death benefit protection that can provide your family with the financial capital needed after you have passed away.

Because there are a few different factors that calculators use to indicate a policy amount, they are reasonably accurate instruments in the process of deciding how much life insurance to purchase.

In this article, you’ll learn what a life insurance calculator is, how to use a life insurance calculator as well as become familiar with the different types of available life insurance calculators.

We will also show you how life insurance calculators can provide rates from several different life insurance companies all at once, making it the easiest way to shop for affordable coverage.

Looking to compare life insurance prices? We can help. Enter your ZIP code to get free quotes from multiple insurers.

Two Types of Life Insurance Calculators – Needs vs Cost of Coverage

When we think of calculators in general, we often associate them with something that we would typically use to get an answer to a mathematical problem. A life insurance calculator works in the same way.

By utilizing questions that require answers in the form of numbers, data is computed to provide an accurate response to the individual using the calculator.

If you’re in the early stages of obtaining life insurance, then you need to know about these two types of life insurance calculators as they will make the entire shopping process very easy and very accurate.

Calculator #1 – Life Insurance Needs Calculators are used in helping you estimate how much death benefit coverage you need.

Calculator #2 – Life Insurance Cost Calculators are used to help provide you with the cost of how much you’ll pay for your life insurance coverage

Your one-stop online guide for life insurance quotes. Get free quotes now!

Secured with SHA-256 Encryption

How Does A Life Insurance Needs Calculator Work?

The life insurance needs calculator should be the starting point of any life insurance process. If you have ever asked yourself the question, “how much life insurance do I need?” then this calculator will help assist in answering that question.

A life insurance needs calculator will focus on a series of questions that revolve around both immediate and future financial needs. Based on your responses, which will always be in the form of a number, the data is crunched to provide a death benefit that will be suitable for covering all financial obligations.

As mentioned, when using a life insurance needs calculator, you will be asked a variety of different questions. We have put together a list of some of the more frequently asked questions that you will see on most online calculators. We will explain the reasoning as to why you are being asked these questions and how it relates to life insurance planning.

TIP:

When considering what an appropriate amount of life insurance coverage might be, the most important thing to think about is how much money your family would need to take care of immediate financial obligations, if you were to pass away suddenly. Second, consider how much money they would need long-term to maintain their current standards of living.

These two variables alone will provide you with an excellent starting point to how much life insurance coverage you should have. The life insurance calculator will help fine-tune that overall amount.

What is Your Current Age?

The younger you are, the higher the chances there will be a need for a longer duration of coverage. Life insurance needs are typically at their highest between the ages of 25 to 50 and will begin to decrease after age 50.

Ideally, you will want your life insurance coverage to last to at least retirement age. Currently, to receive full social security benefits, the age is 66 if you were born between 1943-1959. If you were born in 1960 or later, the age is 67 to collect full SSN benefits and is projected to rise over time.

What’s Your Annual Income?

This number is where the planning of life insurance needs planning begins. Most calculators will start with this question, as it is the base factor used to determine the overall amount of life insurance coverage.

How Many Years Would Your Family Need Income?

The second question will ask you to multiply your annual income times the number of years your family would need to continue maintaining their current standards of living.

A good rule of thumb that most experts recommend is 10-15 times your annual income. This would provide you surviving spouse with enough upfront income to financially plan for the future.

How Many Children Do You Have?

Raising a child is not cheap, and your life insurance coverage should provide enough money to help provide for your children until at least age 18.

A 2015 Consumer Expenditures Survey reported that a middle-income family ($59,200 – $107,400) spent on average $12,980 per year on each child. When adjusting for inflation, in 2020, you can easily round that number up to $16,000 per child.

Now you can make the argument that raising a child would already be factored into your annual income but what new costs may arise from the loss of one parent?

For example, if your spouse was a stay at home parent to your young children, would that change? If your spouse had to find employment, would other costs come into the picture, such as childcare?

The main point here is to look for potential costs that may come into the play when there are small children in the picture and now only one parent.

Will There Be A Need For Health Insurance Coverage?

A need that can often be missed when planning for life insurance is the cost of health insurance. Having to purchase an individual health insurance plan due to the passing of a spouse can become a considerable expense.

If both spouses have the option to purchase health insurance through their employer or if currently receiving Medicare, then this may not be a factor in overall needs planning.

However, if your family is currently receiving health insurance under one spouse’s group plan, you may want to include health insurance costs into your needs planning.

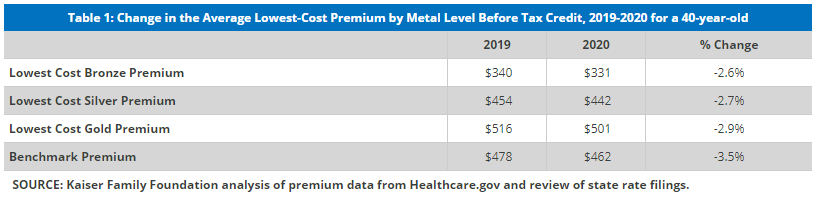

Individual health insurance can be an expensive cost, especially on one parent’s income. Data collected by Kaiser Family Foundation analyzed the average lowest cost premium per metal tier (bronze, silver & gold) for a 40-year old in both 2019 and 2020.

As shown in the table above, there was a decrease in monthly premiums from 2019 to 2020. But even at the lowest tier of bronze, the monthly premium was $331.

Multiplied by 12 months, the annual total comes to $3,972 and doesn’t include what you will need to pay in out of pocket expenses.

Do Any Other Dependents Rely On You Financially?

Outside of your spouse and children, do you have an aging parent that may need caring for? A 2019 Cost of Care Survey conducted by Genworth reports that the National annual average for In-Home Care services was $52,624, while Nursing Home Facility Care cost a yearly average of $102,200.

If you have an aging parent that is going to rely on your help, these potential costs need to be factored into your overall life insurance planning.

We also want to touch upon children from a previous marriage that rely on you. If you don’t already have a court-ordered life insurance policy in effect, plan on adding to your life insurance coverage to cover child support payments.

What Are Your Current Debts & Other Financial Obligations?

This number will be added to the total life insurance amount, ensuring your family won’t be saddled with bills they cannot pay. Include all debts such as credit cards, car payments, school loans, and even your mortgage balance.

In most cases, a surviving spouse will not be held responsible for making payments on outstanding debts that they were not a co-signer on with the deceased spouse. However, if your spouse plans on keeping any of those material possessions that still have outstanding balances, funds will be needed to pay off these balances and need to be factored into the overall coverage.

Will Money Be Needed for Education Expenses?

Children play a significant role in life insurance planning. A second potential cost is the cost of their education. If you want to ensure your children will have the funds to go to college, factor in how much you expect to pay whether they plan on going to community college, a public university or private college.

To provide you with an idea of what college costs, we took a look at a recent report conducted by CollegeBoard.com. Based on their findings, the average annual cost to go to a public four-year in-state college in 2019-2020 was $21,950. The average annual cost for a student to go to a 4-year public out-of-state college with tuition, fees, room, and board fees was $38,330.

Do You Have Current Savings, Investments, Retirement Accounts or Active Life Insurance Policies?

This question is asked because they are viewed as positive amounts of money or assets and are not viewed as an expense. Therefore any positive amounts from these categories are subtracted from the total amount of life insurance needed.

The same applies to any current life insurance policies you may have both group coverage and individually owned policies. If you have any active life insurance policies that are not going to be replaced with new coverage, then the total amount of those policies is subtracted from the total.

Miscellaneous Expenses

Some life insurance calculators will have a section for other miscellaneous expenses, such as leaving money to a charity, setting aside funds specifically for funeral costs, or other small final expenses. You may also want to consider potential medical bills that might not be picked up by a health insurance plan.

How Does A Life Insurance Cost Calculator Work?

If you have just finished completing your life insurance needs analysis, and you have your ideal amount of coverage, a life insurance cost calculator will be the next step to getting a personalized life insurance quote.

Using a quote calculator is a fairly straightforward process and does not require as many questions and answers as the needs calculator. The entire process can take less than 1-2 minutes, depending on the calculator.

Most life insurance cost calculators work quickly by computing user-submitted data against rate tables that have been set by each life insurance company and their products.

The data includes variables such as age, gender, tobacco use, height and weight, state of residence, type of life insurance, and an amount of death benefit coverage being requested. The result provides an estimated life insurance cost from every participating life insurance company within the quote calculator.

Some quote tools may require a few extra pieces of information, such as your parent’s health, if you have ever been treated for specific health conditions and your overall driving history.

A life insurance cost tool that asks for these extra bits of information is great because they can narrow down the companies that will be best based on your responses, which leads to a more accurate life insurance quote.

Once you have entered the required information, the cost calculator will instantly display actual life insurance rates sorting companies from the best price to the highest prices.

Some quote calculators will even provide additional information such as the insurance company’s A.M. Best Ratings and special features like living benefits or the option to apply without a medical exam.

How Are Life Insurance Costs Calculated?

When it comes to actual life insurance rates, those are set by each individual life insurance company. There is a lot of planning and large amounts of data such as life tables (also known as mortality or actuarial tables) that are utilized to determine what a life insurance company will charge for their coverage.

Rates are then matched to age, gender, tobacco use, type of coverage, and overall health classification. Below is an explanation of how life insurance companies use your data to provide you with an estimated life insurance quote.

State or Zip Code

The state or zip code that you live in has zero effect on life insurance rates. You will never see or pay a difference in rates from state to state, as that is not what they are based on. The reason why a quote tool asks for this information is that some companies may not offer a product in the state you live in. By entering your state or zip code, it prevents the life insurance quote tool from showing life insurance products that are not available in your state.

Age

The starting point of any life insurance quote begins with age. Life insurance rates are always going to be cheaper in your younger years. The main reasoning behind this is that when you’re younger, there is significantly less of a chance of developing any high-risk health issues. The chances of the insurance company having to pay out a death claim are lower than that of a person in their seniors years.

Gender

Women will generally incur a lower premium than men of the same age. Remember, a primary factor in the cost of life insurance is life expectancy and women outlive men.

A study conducted by the Centers for Disease Control and Prevention (CDC) reported that men had an average life expectancy of age 76.1. In contrast, women had an average life expectancy of age 81.1.

Tobacco Use

Tobacco users will not be disqualified from getting life insurance coverage. There are rates specifically designed for those who use tobacco products such as cigarettes, chewing tobacco, and cigars, to name a few.

Companies will even consider you if you use medicinal or recreational marijuana. However, because of the use of these products can reduce life expectancy, rates will be higher than those who do not use tobacco or marijuana.

Height & Weight

Height and weight do play a role in the life insurance underwriting process as well as your rates, but it’s not always listed on every life insurance quote calculator.

A calculator that lists height and weight will be able to provide you rates based on each company build chart resulting in a more accurate life insurance quote.

Health Class

The health class is the backbone of determining actual life rates. It can be a bit confusing knowing which one to select as it is required when using the life insurance quote tool. There are four traditional life insurance health classes to choose from and consist of:

- Preferred Plus – (Excellent Health)

- Preferred – (Very Good Health)

- Standard Plus – (Good Health)

- Standard – (Average Health)

The health classification is primarily based on how much of a risk you are to the insurance company having to pay out a claim. If you are not high-risk, the better of a health classification you qualify for, resulting in a lower the premium.

When using the life insurance quote calculator, don’t get too hung up or stressed on which one you should choose. Choose one that you think best fits you so you can get an idea of how much life insurance is going to cost. Final health classes are not determined until you have completed an application and have gone through underwriting.

Type of Coverage

Life insurance is available in all types, from temporary to permanent to exam or without an exam. If you’re looking for the most affordable option, we highly recommend a term life insurance policy.

A term life insurance policy can provide coverage from 1 to 40 years along with a premium that remains locked in until the contract expires. It is also great for being able to purchase more substantial amounts of coverage without breaking the bank, making it the perfect coverage for both young families and seniors.

Coverage Amount

The last part of a life insurance cost calculator is the coverage amount, also known as your death benefit. This is the total amount of money that will be paid out to your beneficiary should you pass away.

If you used the life insurance needs calculator, this will be the amount you would select or enter into the life insurance quote calculator to find out how much your coverage will cost.

Life insurance rates will always cost less for smaller amounts of coverage rather than larger amounts, such as $1,000,000 or higher. This is because of the total amount that the insurance company stands to lose should a claim need to be paid out.

Your one-stop online guide for life insurance quotes. Get free quotes now!

Secured with SHA-256 Encryption

Fast Facts About Life Insurance Calculators

As you work your way through using a life insurance calculator, you might encounter questions that don’t have readily available answers. Here are common questions asked about the process of using a life insurance calculator.

Do Life Insurance Calculators Cost A Fee To Use?

The simple answer is no. A life insurance calculator will never cost any money to use. They are designed to provide you with free information about the potential cost of life insurance. If you encounter a calculator that requires a credit card number or any other payment option, stay away! You are probably looking at a scam.

Life insurance calculators will also never ask you for personal information such as your social security number, complete address, credit card number, or bank account information. The only time that type of information would ever be needed is if you decide to proceed with applying for an actual life insurance policy.

Are Life Insurance Calculators 100% Accurate?

Yes, but to a degree.

For example, the life insurance needs calculator provides a recommended amount of life insurance coverage based on assumptions. It is unable to predict the future or any changes that may happen later in life. A needs calculator should be viewed only as a helpful planning tool to get you thinking about critical financial needs that should be covered by a life insurance policy.

When it comes to the life insurance quote calculator, the rates you receive are 100% accurate. Since they are tied directly to each companies’ rate books, any time there is a change in prices, the life insurance quote calculator is updated immediately.

While the life insurance quote calculator provides up to date accurate rates, it does not necessarily mean you will qualify for the initial quote you receive. The second process is applying for coverage through underwriting. If quoted accurately, your rate will be the same as the one you received from the calculator. If not eligible, you may be offered coverage at a higher rate.

The accuracy of life insurance calculators is what makes entering correct data so important. If you’re calculating a quote and you enter that you are 25 instead of 35 years old, the calculator won’t know that there was an error in the age and will quote a lower number.

Be sure to have all the information needed for the life insurance calculator to get as close to an accurate number as possible for both life insurance and a quote.

Can a Life Insurance Quote Calculator Choose the Best Company?

No, not necessarily, but it can help significantly.

Could you imagine having to call multiple life insurance companies to get a quote? That would take days, if not weeks just to find out which company will offer the best price for your life insurance coverage. A life insurance quote calculator eliminates that completely and provides results quickly.

The purpose of a quote calculator is to display life insurance rates from multiple companies allowing you to see which companies can offer you the best rate for life insurance coverage.

Shopping based on price does not always mean it will be with the best company. The best-priced company may not be able to offer you certain policy features or even be the best option for underwriting certain medical risks.

Pros & Cons of Online Life Insurance Calculators

Overall, using a life insurance calculator is a helpful tool, as long as you are aware of the potential limitations. Here are a few pros and cons to be aware of.

Pros

- Very easy to both understand and use.

- Helps greatly in planning for overall life insurance needs.

- Easily compare rates from dozens of companies instantly.

- Can often apply for coverage online when you find the best coverage and rates.

- It’s free to use!

Cons

- Will not be able to 100% pinpoint the exact amount of life insurance needed.

- Can potentially choose the incorrect health class.

- You won’t be able to add on items such as riders to your quote.

- You won’t be able to discuss questions to clarify which policy or company is best for your individual situation.

Alternatives to Online Life Insurance Calculators

An online life insurance calculator can provide quick and reasonably accurate information to both life insurance needs as well as life insurance quotes. All you need to do plug in the required information, and within minutes, you have the answer to your question.

But what about alternatives to an online life insurance calculator? Are there any?

Calculating life insurance needs is not only limited to online quote tools. There are a few popular methods that have been used for a long time. Below are a couple easy to use methods and formulas worth looking into.

Rule of Thumb Method – 10x Annual Income

A method commonly suggested by many insurance agents and financial experts is the simple rule of thumb method, otherwise known as 10x your annual income. This calculation requires no in-depth planning as all you need to do is multiply your yearly income by 10, which will result in the total amount of life insurance you should have.

The theory behind this calculation is that it should provide enough money for your spouse to maintain their living standards without financial interruption. A portion of the death benefit is also suggested to be invested so that it can grow with interest and that can become a future source of income.

The 10x rule of thumb method is an easy and widely used method that can work. However, it does lack some of the important planning features of the needs calculator. If you use the 10x income method, you may want to increase it to 12-15x. With inflation, increases in the cost of living, and unexpected expenses, it might be a safer estimate.

DIME Method

The DIME method addresses four primary areas of concern where life insurance would be most needed. These areas include debt, income, mortgage, and education, which makes up the term DIME. Here is a closer look as to how this simple method works.

DEBT

First, gather together all your outstanding debts. This may include credit cards, loans, and any other financial obligations that have a balance owed. You may also want to factor in an amount for potential future debts such as funeral expenses or medical bills.

INCOME

After you have your total amount of debt, the next step will focus on income replacement. This step is exactly like the 10x you income or rule of thumb method where you take your pre-taxed annual income and multiply it by (x) number of years. We recommend at least 10-15x.

MORTGAGE

The third part of the DIME method has to do with your mortgage balance. Simply find out how much it would take for your spouse to pay off the outstanding mortgage balance.

EDUCATION

The fourth and final step has to do with education and the cost it would require to provide it to your children if you were to pass away. You will want to calculate the total costs associated with higher education, such as a 2 or 4-year college. Don’t forget to include extra fees for housing, food expenses, books, electronics, transportation, etc.

Once you have the totals for each DIME category, all you will need to do is add all four amounts together. Your answer will be the amount of life insurance coverage you will need. The DIME method can be an excellent way of figuring out how much life insurance you need. It does involve focusing on additional areas whereas the rule of thumb focuses on just replacing income.

Life Insurance Needs Worksheet

If you prefer a pen-and-paper method for figuring out how much life insurance you’ll need to purchase, you can sit down with a life insurance needs worksheet.

Below is an example of a basic life insurance needs worksheet that was created by Life Happens.

| Sample Life Insurance Needs Worksheet | ||

|---|---|---|

| INCOME | ||

| #1. Total annual income your family would need if you died today What your family needs, before taxes, to maintain current standards of living (Typically between 60% – 75% of total income) |

$________ | |

| #2. Annual income your family would receive from other sources For example, a spouse’s earnings or a fixed pension. |

$________ | |

| #3. Income to be replaced Subtract line 2 from line 1 |

$________ | |

| #4. Capital needed for income Multiply line 3 by the appropriate factor in Table A located below. Factor_____. |

$________ | |

| EXPENSES | ||

| #5. Funeral and other final expenses Typically the greater of $15,000 or 4% of your estate |

$________ | |

| #6. Mortgage and other outstanding debts Include mortgage balance, credit card balance, car loans, etc. |

$________ | |

| #7. Capital needed for college Estimated cost per child |

$________ | |

| #8. Total capital required Add items 4, 5, 6 & 7 |

$________ | |

| ASSETS | ||

| #9. Savings and investments: Bank accounts, money market accounts, CDs, stocks, bonds, mutual funds, annuities, etc. | $________ | |

| #10. Retirement savings: IRAs, 401(k)s, SEP plans, SIMPLE IRA plans, Keoghs, pensions, and profit-sharing plans | $________ | |

| #11. Present amount of life insurance Including group insurance as well as insurance purchased on your own |

$________ | |

| #12. Total incoming producing assets Add lines 9,10 and 11 |

$________ | |

| #13. Life insurance needed Subtract line 12 from line 8 |

$________ | |

Table A

| Number Of Years Income Needed | Multiplied By “X” |

|---|---|

| 10 | 8.8 |

| 15 | 12.4 |

| 20 | 15.4 |

| 25 | 18.1 |

| 30 | 20.4 |

| 35 | 22.4 |

| 40 | 24.1 |

Work With An Experienced Life Insurance Agent

The final way to calculate your life insurance needs is through the help of an experienced life insurance agent or financial advisor. Sometimes a phone call or email is the best way of getting your questions answered as accurately as possible.

As an insurance company, we’re here for you, and we take our job seriously. We’re here to help answer your questions and help get you the right coverage you need for a price you can afford.

Your one-stop online guide for life insurance quotes. Get free quotes now!

Secured with SHA-256 Encryption

What Type of Life Insurance Do I Need?

When calculating how much life insurance you need, the next question inevitably is what type of life insurance will you need. Two of the most popular options available are term insurance and whole life insurance.

Term Life Insurance

Term life insurance is beneficial for just about anyone who is between the ages of 18 to 80 years old. It is very affordable compared to whole life insurance, which can cost 6-10x more! Since term insurance is so affordable, it can often be the best choice of coverage for young couples, especially with small children who need a large amount of coverage.

Before purchasing a term policy, you will need to decide on a contract length, which is generally available in 1, 10, 15, 20, 25, 30, 35, or 40-year durations.

Regardless of the contract length you choose, premium payments will remain the same price throughout the entire term duration. Most term policies also offer a conversion option that will provide an opportunity to convert your policy into a permanent plan once the term contract expires.

If you think about it, you are getting the best of both worlds when it comes to term insurance. You get to pay lower premiums throughout the entire term duration with the option to convert to a permanent plan if needed later in life.

Whole Life Insurance

Whole life insurance is best for people who are looking for permanent protection that also like the idea that their coverage will accumulate in cash value growth over time. As mentioned, whole life insurance costs much more than term insurance.

The reason why it is so expensive is that it is permanent life insurance coverage and will last an entire lifetime. However, that is not the only factor. Whole life insurance is like a forced savings account and requires a higher premium in order for the cash account. Every time a premium payment is made, a portion will go into the cash-value account to help make it grow each year.

In addition to the guaranteed cash growth aspect, if your whole life insurance policy comes from a company that participates in paying out dividends, it can accumulate in additional cash growth.

Many financial experts such as Dave Ramsey, Suze Orman, and Clark Howard, to name a few, will tell most people to stay far away from whole life insurance. The reason being is that they believe that life insurance shouldn’t be viewed as an investment vehicle.

The extra money that is being invested in the cash value account could be better invested elsewhere for potentially higher returns. This is commonly referred to as the “buy term and invest the difference” theory.

Other experts will argue that whole life insurance does have its place but mostly for high net worth individuals. A person with a significant amount a wealth may be able to who utilize whole life insurance as an investment strategy when retirement accounts have been maxed out or who are simply trying to diversify their overall portfolio.

Guaranteed Universal Life Insurance

When deciding on a type of life insurance coverage, you are not limited to just term or whole life. A third option is guaranteed universal life insurance, otherwise known as GUL.

This type of life insurance is positioned right in the middle of term insurance and whole life insurance. Some even referred to it as “permanent term insurance.”

Guaranteed universal life or GUL is designed to offer permanent life insurance protection with an affordable fixed premium.

Whereas whole life insurance uses a portion of your premium to grow the cash value, guaranteed universal life does not. It is not designed to build cash value, which keeps the premium affordable.

When planning your life insurance, see if there may be a need for permanent protection. If so, consider a combination of both term insurance and guaranteed universal life insurance.

Examples of Other Types of Life Insurance Calculators

Looking for specific information on a certain life insurance calculator? Here are four of the most searched calculators online and how they work, what they provide and where you can find one.

Term Life Insurance Calculator

- Calculates rates specifically for term life insurance

- Organizes term insurance rates from lowest to highest priced

- Can choose from term lengths of 1, 5, 10, 15, 20, 25, 30, 35 or 40 years

- Can adjust coverage amounts from $25,000 up to $10,0000

- Choose from companies that offer an exam or companies that offer no exam to apply

- View companies A.M. Best ratings otherwise known as financial strengths

- Learn about conversion options from each company

- Find out which companies offer an eDelivery policy

- See the cost for annual or monthly payments

- Apply instantly online in the comfort of your home

Universal Life Insurance Calculator

- Calculates rates specifically for universal life insurance

- Organizes universal life insurance rates from lowest to highest priced

- Choose to pay premiums up to age 95, 100 or 120

- Can adjust coverage amounts from $25,000 up to $10,0000

- Choose from companies that offer an exam or companies that offer no exam to apply

- View companies A.M. Best ratings otherwise known as financial strengths

- Find out which companies offer an eDelivery policy

- See the cost for annual or monthly payments

- Apply instantly online in the comfort of your home

Your one-stop online guide for life insurance quotes. Get free quotes now!

Secured with SHA-256 Encryption

Whole Life Insurance Calculator

- Calculates rates specifically for whole life insurance

- Organizes whole life insurance rates from lowest to highest priced

- Choose to pay level or limited payment options

- Can adjust coverage amounts from $25,000 up to $10,0000

- See a complete illustration of how coverage will perform (guaranteed and non-guaranteed cash values)

- View companies A.M. Best ratings otherwise known as financial strengths

- Find out which companies offer an eDelivery policy

- See the cost for annual or monthly payments

- Apply instantly online in the comfort of your home

Your one-stop online guide for life insurance quotes. Get free quotes now!

Secured with SHA-256 Encryption

Mortgage Life Insurance Calculator

- Calculates life insurance rates specifically for covering the balance of a mortgage

Ready to Compare Life Insurance Rates?

It’s free, fast and super simple.

Looking to compare life insurance prices? We can help. Enter your ZIP code to get free quotes from multiple insurers.

Your one-stop online guide for life insurance quotes. Get free quotes now!

Secured with SHA-256 Encryption

Leslie Kasperowicz

Farmers CSR for 4 Years

Leslie Kasperowicz holds a BA in Social Sciences from the University of Winnipeg. She spent several years as a Farmers Insurance CSR, gaining a solid understanding of insurance products including home, life, auto, and commercial and working directly with insurance customers to understand their needs. She has since used that knowledge in her more than ten years as a writer, largely in the insur...

Farmers CSR for 4 Years

Editorial Guidelines: We are a free online resource for anyone interested in learning more about life insurance. Our goal is to be an objective, third-party resource for everything life insurance-related. We update our site regularly, and all content is reviewed by life insurance experts.