Life Insurance for Women: A Guide on What You Need to Know

Free Life Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Mathew B. Sims

Editor-in-Chief

Mathew B. Sims is Editor-in-Chief and has authored, edited, and contributed to several books. He has been working in the insurance industry ensuring content is accurate for consumers who are searching for the best policies and rates. He has also been featured on sites like UpJourney.

Editor-in-Chief

UPDATED: Nov 22, 2023

It’s all about you. We want to help you make the right life insurance coverage choices.

Advertiser Disclosure: We strive to help you make confident life insurance decisions. Comparison shopping should be easy. We are not affiliated with any one life insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different life insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about life insurance. Our goal is to be an objective, third-party resource for everything life insurance-related. We update our site regularly, and all content is reviewed by life insurance experts.

UPDATED: Nov 22, 2023

It’s all about you. We want to help you make the right life insurance coverage choices.

Advertiser Disclosure: We strive to help you make confident life insurance decisions. Comparison shopping should be easy. We are not affiliated with any one life insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different life insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

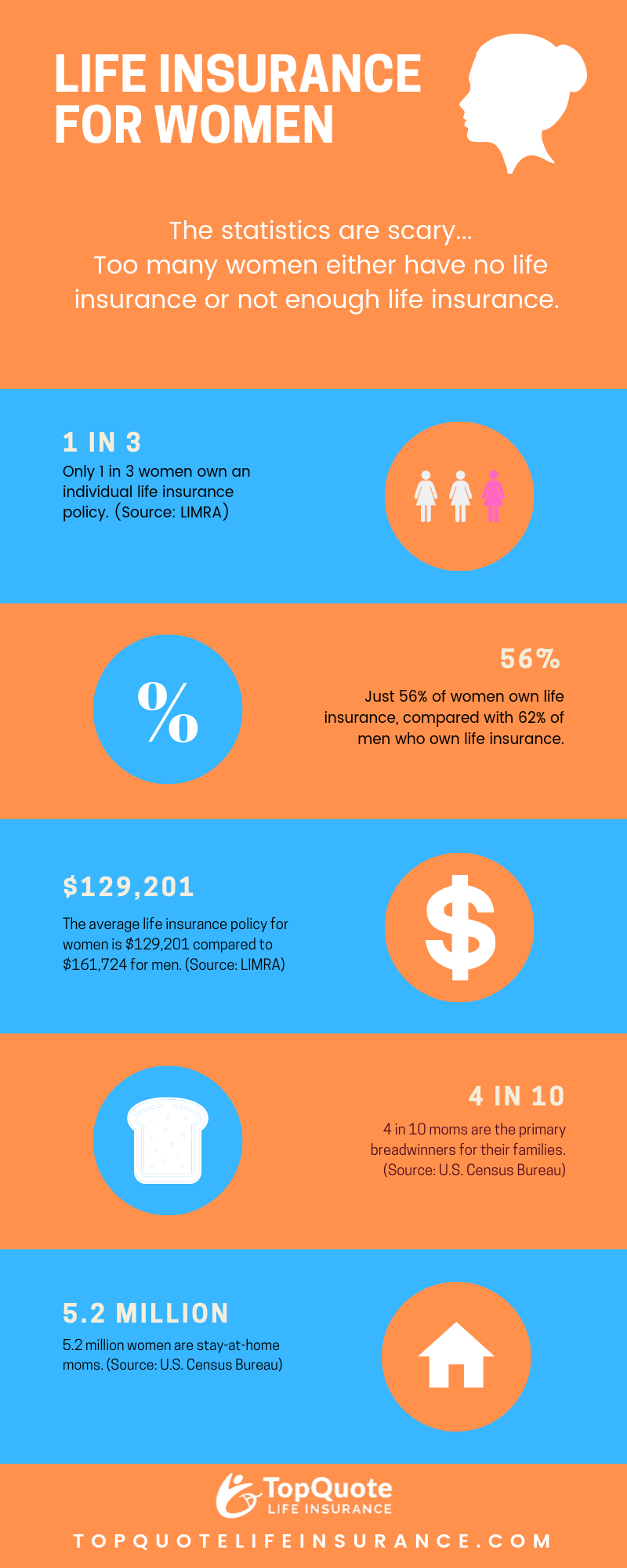

Research shows that only 56% of women in the United States have life insurance. That’s well below the average life insurance ownership rate for men, which is 62%.

From corner-office CEOs to stay-at-home moms, the reality is that women around the country are providing for themselves and their families on a daily basis.

This means that they could leave their loved ones not only emotionally depleted but also financially strapped when they die. While it can be a touchy topic to broach, it’s essential to understand why life insurance for women is such a critical investment.

Today, we’re exploring this topic in full. Join us as we share why this decision could be one of the most important ones you make.

Looking to compare life insurance prices? We can help. Enter your ZIP code to get free quotes from multiple insurers.

Why Should Women Prioritize Life Insurance?

Especially if you live in a household where the man is the primary breadwinner, you might prioritize his life insurance coverage only.

However, it’s equally important (if not more so) to make sure you’re covered, too. Here are a few reasons why.

You’ll Pay Less or Get More Coverage

In almost every country around the world, women tend to live longer than men. In fact, the World Health Organization estimates that the average female life expectancy exceeds that of males by around six to eight years.

In the United States, specifically, most women live to be around 81.1 years old, while most men live to be 76.1 years old. From higher risk propensities to more dangerous jobs, the reasons for this imbalance are vast and varied.

What does this mean for women who are looking for life insurance policies? A longer life expectancy can drive your costs down, or help you obtain significantly lower prices for life insurance coverage. This is especially true if you’re young and healthy.

Your Caretaker Work is Critical

You don’t have to bring in a six-figure salary every year to be important to your family. If you choose to stay at home to take care of your family, the work you do as a woman is invaluable. In fact, some studies estimate that your help at home is worth more than $160,000 per year!

This applies to raising children, attending to aging parents, or even caring for a sibling. You’re irreplaceable to the loved ones in your life and your death could leave them scrambling if there are no plans in place to continue their care.

From school requirements to medical expenses, transportation, housekeeping and more, there are myriad expenses associated with at-home care. If your surviving spouse is left to shoulder those burdens, it could cut into his work hours and in turn, reduce his income.

Life insurance can help.

When you have a policy in place, it can help cover those costs. This way, you can make sure that those who need you will still have access to the same level of attention and protection that you’ve provided all of this time.

Working Mothers Bring in Critical Income

Of course, women who work outside of the home still need life insurance.

The income that a working mother provides is essential to her household. It often helps cover the costs of basic living expenses, including:

- Groceries

- Clothing

- Utilities

- School needs

In addition, you might set aside a portion of your paycheck to go toward college savings or a retirement fund. If you pass away, life insurance can help supplement the gap that will result when this steady influx of cash suddenly stops.

This support is especially helpful for single mothers, who won’t have a spouse or partner who can take the reigns. Life insurance can help your surviving loved ones cover childcare costs, medical expenses, future tuition, and other debts.

Debts Must Be Paid

If you have any outstanding debts, they’ll fall to your family members after your death. In addition, there will also be final expenses to contend with. A life insurance policy can make these payments easier to meet.

If you have debts when you die but no insurance policy in place, your spouse or designated executor of your will is responsible for making sure they’re paid. This often means selling anything and everything of value within your estate. To protect your belongings and ensure your loved ones can continue to live in your home, it’s smart to go ahead and invest in a policy.

Single Women Qualify, Too

Single women should also give life insurance a second look. Even if there’s no one who depends on you, your debts will become a burden for someone upon your death.

Even if you’re debt-free, the average funeral costs more than $7,000. Who will cover that for you?

While you might not have to worry about helping a spouse afford retirement dreams or children attend the college of their dreams, you should still pursue coverage.

Your one-stop online guide for life insurance quotes. Get free quotes now!

Secured with SHA-256 Encryption

Benefits of Life Insurance for Women

Now that we’ve covered a few of the reasons why women should prioritize a life insurance policy, let’s take a closer look at a few of the benefits you can expect to reap when you find one that fits.

Financial Security

Financial security is the top benefit of life insurance for women. Put simply, a policy will help make sure that your loved ones don’t have to take a major loss as they attempt to continue on without you.

This is the best way to give peace of mind to your family, allowing them to maintain the same quality of life when you pass. Regardless of your employment or your marital status, this is one benefit that you cannot ignore.

Borrowing Against the Cash Value

As you begin shopping around for the best life insurance plan, you’ll find that there are myriad types to choose from, including:

- Term life insurance

- Universal life insurance

- Whole life insurance

In most cases, the best life insurance plan will be a term life insurance policy. The reason being is that it’s affordable for the family, and it can provide the most substantial amount of coverage based on the low cost.

Permanent life insurance policies such as universal life and whole life insurance will have the ability to build cash value. The cash value can be borrowed against to cover a variety of needs.

From paying off your bills to starting a new business or even paying for your children to go to college, this money can come in handy during times when you need it the most.

Care for Elderly/Aging Family Members

Especially as they approach middle age, it’s common for women to assume the role of caregiver on either a full-time or part-time basis.

Your parents and siblings are aging alongside you, and there may come a time when you have to step in and attend to their needs. If you add them as a beneficiary on your life insurance policy, you can be confident that their needs will be met even after you’re gone.

Living Benefit in the Event of Critical or Chronic Illness

It’s true that moms never take a sick day. However, have you ever considered what life would be like if you were stricken with a critical or chronic illness? What would your loved ones do, and how would it affect your immediate family?

Would your bills get paid? Would your family be able to eat, go to school, and participate in routine activities if you weren’t physically able to handle them?

Life insurance can help with this.

In your research, you’ll find that there are several life insurance companies that offer policies that you can endorse with a rider designed to cover your family financially if this situation were to ever occur.

The riders that offer these features are called living benefit riders. In most cases, you will not need to pay an extra premium to add them as it has become a standard feature on many life insurance policies.

A life insurance policy with living benefit features can advance a payout of the policy’s death benefit if you become suddenly ill with a chronic or critical illness.

You’ll be able to apply these funds toward your medical or living expenses to keep your family on its feet.

Find the Life Insurance Policy You Need

Especially given the complex and often confusing nature of the insurance niche, it’s all too easy to put off buying a policy until it’s too late. Women are especially hesitant, assuming that only men contribute enough to leave a financial gap upon their passing.

Regardless of your family structure, the number of dependencies, or employment status, your life holds incredible value and you play a critical role. That means there will be needs that go unmet when you pass away.

The good news? When you search for life insurance for women, you’ll find many policies that can help you protect those needs right now.

Looking for the right one? That’s where we come in.

We make it easy for users to receive and compare 100% accurate online life insurance quotes from some of the top companies in the nation, all in under one minute.

Request a quote on our platform and see for yourself how easy it can be. There’s no cost, no obligations, and no sales pressure — only answers.

Ready to Compare Life Insurance Rates?

It’s free, fast and super simple.

Looking to compare life insurance prices? We can help. Enter your ZIP code to get free quotes from multiple insurers.

Your one-stop online guide for life insurance quotes. Get free quotes now!

Secured with SHA-256 Encryption

Mathew B. Sims

Editor-in-Chief

Mathew B. Sims is Editor-in-Chief and has authored, edited, and contributed to several books. He has been working in the insurance industry ensuring content is accurate for consumers who are searching for the best policies and rates. He has also been featured on sites like UpJourney.

Editor-in-Chief

Editorial Guidelines: We are a free online resource for anyone interested in learning more about life insurance. Our goal is to be an objective, third-party resource for everything life insurance-related. We update our site regularly, and all content is reviewed by life insurance experts.