Mortgage Protection Insurance vs. Mortgage Life Insurance

Free Life Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Mathew B. Sims

Editor-in-Chief

Mathew B. Sims is Editor-in-Chief and has authored, edited, and contributed to several books. He has been working in the insurance industry ensuring content is accurate for consumers who are searching for the best policies and rates. He has also been featured on sites like UpJourney.

Editor-in-Chief

UPDATED: Mar 25, 2024

It’s all about you. We want to help you make the right life insurance coverage choices.

Advertiser Disclosure: We strive to help you make confident life insurance decisions. Comparison shopping should be easy. We are not affiliated with any one life insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different life insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about life insurance. Our goal is to be an objective, third-party resource for everything life insurance-related. We update our site regularly, and all content is reviewed by life insurance experts.

UPDATED: Mar 25, 2024

It’s all about you. We want to help you make the right life insurance coverage choices.

Advertiser Disclosure: We strive to help you make confident life insurance decisions. Comparison shopping should be easy. We are not affiliated with any one life insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different life insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

“Mortgage protection insurance or mortgage life insurance are policies that provide funds to help pay off an outstanding mortgage balance should the homeowner pass away.”

If you own a home or have recently purchased a new home, should you purchase mortgage protection insurance?

In this article, we will discuss what mortgage protection insurance provides as well as what to look out for. We will explain who will and who will not benefit from a mortgage protection insurance policy.

Plus, we will also provide you with better alternatives for those looking to protect their mortgage payments while protecting their family from financial burdens after the death of a breadwinner.

A new home tends to come with an expensive monthly mortgage payment for most home buyers. It will most likely be the most significant expense you and your family will have to pay on.

If you have purchased a new home within the last year or two, there’s a good chance your mailbox has been getting flooded with several letters attempting to convince you to purchase mortgage protection insurance (MPI) or mortgage life insurance (MLI)?

You’ve probably even noticed that the information in the letters is accurate from the balance left to pay on your mortgage, down to your lender’s name.

The letters often end with scare tactics suggesting that without MPI, your family could be left out in the cold if something should happen to you. As you probably know, these notices are simply designed to engage you in response.

The truth is that some people can and will benefit from mortgage protection insurance. But for the vast majority of homeowners, there are better options on the market.

In general, some mortgage protection insurance options can be substantially more expensive and far less flexible than options such as mortgage life insurance, which is really just another name for a traditional term life insurance.

However, for those with medical issues that cannot qualify for a term life insurance policy, an MPI policy may just be the best option in protecting your mortgage payments.

In addition, there are options that some mortgage protection insurance policies offer, which could make them worthwhile to people in particular financial and medical positions.

Looking to compare life insurance prices? We can help. Enter your ZIP code to get free quotes from multiple insurers.

What Exactly Is

Mortgage Protection Insurance?

| Company | AM Best Rating | Type of Coverage | Eligible Ages | Coverage Amounts | Policy Features | Additional Info |

|---|---|---|---|---|---|---|

| AIG | A | Term Insurance | 20-80 | $100,000 - $1,000,000+ | 18 Different Term Lengths | Learn More |

| Assurity | A- | Term Insurance | 18-75 | $25,000 - $1,000,000+ | Return of Premium | Learn More |

| Banner | A+ | Term Insurance | 20-75 | $100,000 - $1,000,000+ | 40 Year Term Lengths | Learn More |

| Pacific Life | A+ | Term Insurance | 18-80 | $50,000 - $1,000,000+ | No Exam for Seniors | Learn More |

| Protective | A+ | Term & Universal Blend | 18-75 | $1,00,000 - $1,000,000+ | Decreasing Death Benefit | Learn More |

Mortgage protection insurance is a form of life insurance, often (term life insurance) that is sold by both banks and private insurance companies to protect your mortgage payments or even home equity loans.

Banks will solicit the insurance coverage by getting your information and the details to your mortgage from your lender, as the two are often affiliated.

Private insurance companies will often get your mortgage information through public records, mailing lists of recently purchased homes, or by utilizing real estate websites such as Zillow or Redfin. That’s how they’re able to present you with such accurate information about your mortgage.

As mentioned, what they’re selling is a form of life insurance that is intended to provide funds to help cover your mortgage payments in the event of your death.

As with any life insurance policy, it’s a financial safety net that allows for your surviving spouse and children not to have to worry about coming up with funds to help pay for daily expenses.

While this may sound like an excellent reason to purchase mortgage protection insurance, we want you to understand how the coverage works compared to a traditional term life insurance policy which can be a much better alternative.

How Does Mortgage Protection Insurance Work?

| Policy Features | Mortgage Protection Insurance | Traditional Term Life Insurance |

|---|---|---|

| Type of Coverage: | Term Insurance | Term Insurance |

| Other Names: | Decreasing Term Insurance Mortgage Life Insurance |

Level Benefit Term Insurance Mortgage Life Insurance |

| Coverage Amount: | Matches Mortgage Balance | Based On Overall Needs |

| Death Benefit: | Decreasing | Level |

| Contract Lengths: | 15 or 30 Years | 10, 15, 20, 25, 30, 35 & 40 Years |

| Death Benefit Payout: | Bank or Lender | Beneficaries of Insured |

| Underwriting: | No Exam Required | Exam & No Exam Options |

| Cost: | $$$ | $ |

Quick Note

Several of today’s marketing pieces mailed to new home buyers are in fact solicitation to purchase traditional term life insurance but are being referred to as “mortgage protection insurance.”

While Top Quote Life Insurance is in favor of using traditional term life insurance to protect your mortgage, we want our readers to be cautious of mortgage protection that is offering a offers a decreasing death benefit and that only pays directly to your bank or lender should you pass away.

Mortgage insurance protection or mortgage life insurance can be a little confusing as they are both term life insurance policies.

If you received a solicitation in the mail and it has caught your interest in how you can protect your mortgage payments, it’s essential to read all the fine details of the letter before taking action. Ask for professional assistance if you have any questions pertaining to the offer for coverage.

Most mortgage protection insurance policies work by paying off your mortgage balance if you were to pass away while the policy is active. The contract length generally matches the full duration of how long it will take to pay off your mortgage loan, typically lasting 15 or 30 years.

The type of mortgage insurance that we want you to be aware of is the plans that offer a decreasing death benefit and only pay your mortgage balance directly to the lender and not to your beneficiary.

For example, if the policy started by covering a $250,000 mortgage balance, and the insured died when the mortgage was paid down to $150,000, the mortgage protection policy would only pay the remaining $150,000 directly to the mortgage lender.

Although your family would not need to worry about making mortgage payments, the downside is that they would not receive any portion of the death benefit payment.

Mortgage protection insurance is not all bad and offers both advantages as well as disadvantages.

Your one-stop online guide for life insurance quotes. Get free quotes now!

Secured with SHA-256 Encryption

Benefits of Mortgage Protection Insurance

MPI policies offered today vary widely in their features, such as a decreasing death benefit and limited fixed rates. While we are not the biggest fans of these types of insurance being offered to new home buyers, it’s only fair to list the benefits as it can be beneficial to some people.

No Medical Exams

The most important benefit is the fact that there is generally no medical underwriting necessary for a mortgage protection insurance policy.

This means that almost anyone can qualify for an MPI policy, as approval is often guaranteed. Even those in poor health which would not medically qualify for a traditional term life policy will benefit from an MPI policy.

The same can be said for someone who applied for life insurance but received approval that was too expensive due to a pre-existing medical condition.

Non-Death Related Protection Features

Depending on the company offering protection, some MPI policies will provide a benefit that will cover your mortgage payments due to an accident, temporary disability, or unemployment as long as it was not due to quitting or being fired from your job.

Can Supply Supplemental Protection

If the policy is affordable, it’s a good way to supplement an existing life insurance policy. Your MPI policy will pay off your mortgage and your family can use the benefits of your other life insurance policy for other expenses.

However, if you do not have any major health risks that would cause concern, you will find that traditional term insurance will be the most affordable option.

Downsides of Mortgage Protection Insurance

Since there are only certain situations where MPI would be the best option for protection, it’s possible to see why there would be many downsides compared to owning your own traditional term life insurance.

We discuss them below and offer a rundown on how to get the best possible coverage if you do find yourself in need of mortgage protection insurance.

Limited Fixed Premiums

Some MPI policies only offer a premium rate that is fixed for only the first five years. This means your premiums can spike with no warning after the fifth policy year. This is unlike a true mortgage life insurance policies, which generally offer a fixed rate for the entire duration of the policy.

Declining Payout

Most MPI policies offer a declining benefit, which reduces as your mortgage balance decreases. For most policies, the premiums don’t shrink as the payout does, so you can find yourself paying the same amount for less coverage throughout the life of your MPI policy.

More Expensive

Since MPI policies often don’t require medical underwriting, they tend to be more expensive than options like traditional term life insurance. Mortgage protection insurance policy premiums can be more than double the price of comparable term life policy premiums.

Direct to Lender Payout

Most MPI policies do not pay out a death benefit to your beneficiaries. Instead, they pay directly to the mortgage lender. This is good in that it pays off the mortgage, but it can be a problem if your family needs money for other expenses.

Limited Scope

Many times MPI policies only payout in the event of accidental death. This means the policy has many more exclusions that mortgage life policies, which cover many different kinds of deaths, not just accidental.

Limited Transparency

It is often hard to get an online quote for mortgage protection insurance. For this reason, there is little transparency around most policies. You have to know exactly what you’re looking for in order to get the best MPI policy for your needs, and it isn’t as quick as getting a quote for traditional types of life insurance policies.

Age Limits

MPI is often only available up to a certain age. For example, some companies only offer 30-year policies for those 45 or younger, and 15-year policies to people 60 or younger.

Bundled Mortgage Protection Insurance

Try to avoid MPI policies that come bundled with your house or mortgage. This means that you would have to get a new policy if you moved homes. Since premiums tend to increase with age, you could end up paying more for the coverage on your new home.

Who Exactly Would Benefit From

Mortgage Protection Insurance?

The limited benefits of MPI narrow its scope to those with medical conditions that prevent them from obtaining or affording a level benefit, fixed premium mortgage life insurance policy.

If you don’t qualify for mortgage life insurance, or the quoted premiums are too high, you can look into MPI, since most plans don’t require a medical exam.

There are certain instances where mortgage protection insurance can supplement your existing life insurance, but this is rare.

Usually, if you qualify for life insurance in the first place, it will cost you less to simply increase your existing policy by .

Mortgage life insurance is generally a much better alternative to MPI. This is why we’ve included a little information about the benefits of mortgage life insurance below.

Your one-stop online guide for life insurance quotes. Get free quotes now!

Secured with SHA-256 Encryption

Private Mortgage Insurance (PMI)

Private mortgage insurance (PMI), it should be noted, is entirely different from mortgage protection insurance (MPI).

You may already have PMI as it is often required by mortgage lenders if your down payment is less than 20% of the total cost of the home.

PMI is a policy that protects the lender in the event that you default on the loan. It does not protect your family in the event that something happens to you.

Is Traditional Term Life Insurance Best for Mortgage Protection?

In most scenarios, the best mortgage protection will be in the form of a traditional term life insurance policy. You see, mortgage life insurance is not a special type of life insurance policy. Companies have coined the term “mortgage life insurance” as another way to market the need for having life insurance coverage.

Is mortgage life insurance necessary?

Yes definitely. Your mortgage balance is one of many reasons to purchase life insurance, but not it’s not the only reason. The death benefit of a life insurance policy provides the necessary funds to help your family to continue living the same lifestyle with the loss of your income.

What else does life insurance protect against?

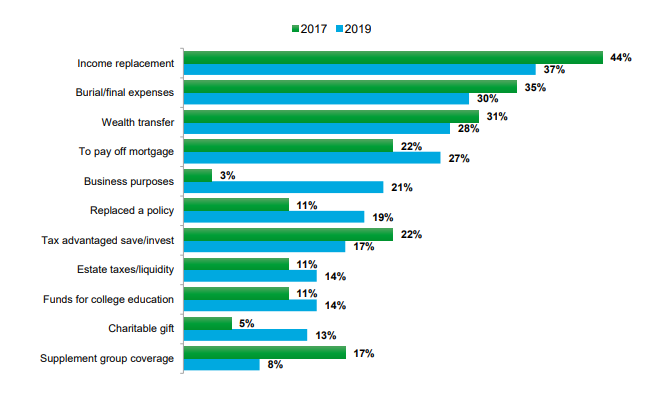

Each year, not-for-profit organizations Life Happens, and LIMRA work together to release its annual Insurance Barometer Report. The report is packed with valuable data about how U.S. based consumers view life insurance.

The Insurance Barometer Report is a helpful tool for both insurance companies as well as life insurance agents in understanding what consumers want when it comes to buying life insurance.

One statistic, in general, focused on consumer responses from 2017 compared to 2019 as to what their main reasons were for purchasing life insurance coverage. See table below:

2017 vs. 2019 Reasons for Purchasing Life Insurance

As you can see from the table, there are several reasons to purchase coverage, but the fourth highest reason why people buy life insurance is to pay off their mortgage. Also, take notice that this response was up 5% from 2017.

How can term life insurance protect your mortgage?

A traditional term life insurance policy provides you complete control from choosing how long the coverage will last, to the amount of coverage you will need, and who will receive death benefit should you pass away.

When using term life insurance to protect your mortgage, you will have the option to choose from multiple contract lengths ranging from 10, 15, 20, 25, and 30 years. Banner life insurance even offers a 40-year term length, currently making it the longest known contract length available.

Ideally, choosing a contract length to match the duration of your mortgage loan would be the best option, but it’s not required. Term insurance is the least expensive life insurance option, but longer contract lengths will cost more than shorter contract lengths. If you’re on a budget, consider a shorter contract length while shifting your focus on the death benefit.

The death benefit is the most crucial factor in life insurance planning and is paid out in one lump sum tax-deferred payment.

When deciding on how much coverage you should have, start with the total amount that would be needed to pay off your mortgage. Once you have that amount, the next step will be adding other financial needs your family would need help with if you were to pass away.

If you are stuck in your planning, a great tool in helping out with how much life insurance coverage you should have is by using a life insurance worksheet or life insurance needs calculator.

A life insurance calculator offers a series of multiple life insurance planning questions. Once you have answered the calculator questions, your responses will be analyzed to provide you with a recommendation for an amount of life insurance coverage.

The greatest benefit of utilizing term life insurance to protect your mortgage payments is the fact that you get to choose your beneficiary. In most cases, your beneficiary is likely to be your spouse and not the lender of your mortgage.

Should you pass away, your spouse would file a claim, and within a few weeks, they would receive the full value of the life insurance policy. Since the death benefit is not paid to your mortgage lender, the proceeds can be used however needed.

Your spouse can choose to continue making mortgage payments, pay off the mortgage completely, use it for daily living expenses, pay debts, etc. There are no restrictions on how they choose to use the death benefit.

Benefits of Using Term Life Insurance for Mortgage Protection

As mentioned, in our opinion, individual term life insurance, also referenced to as (mortgage life insurance), is just a better option when it comes to not only protecting your mortgage payments but also your family.

Here is a recap of the top reasons to consider a term life insurance policy.

Flexible Benefit Payouts

MPI usually pays benefits directly to the mortgage lender. Term life insurance used as mortgage life insurance, on the other hand, pays directly to your beneficiaries. This way, your family can use that money wherever it’s needed, instead of just for the mortgage.

Affordability

Even the more expensive mortgage life policies are generally cheaper than their MPI counterparts. On average, mortgage protection insurance is more than double the cost of a mortgage term life insurance plan.

Coverage and Cost Stay The Same

Standard mortgage life insurance policies neither decrease in coverage nor increases in cost. This means you’ll pay the same amount throughout the entire contract length you choose. No spikes in premiums and the amount of coverage you select will not decrease as your mortgage balance shrinks.

Flexible Terms

MPI policies are only for the life of your mortgage, usually 15 or 30 years. Mortgage life policies, on the other hand, are available in 10, 15, 20, 30, and even 40-year terms.

Added Coverage

Certain mortgage life policies allow you to access your death benefits early in special circumstances. Most commonly these benefits can be released in the case of a chronic, critical or terminal illness. Many standard MPI policies only cover accidental death, where mortgage life policies offer a wider range of coverage to ensure that your family is fully protected.

Can be Changed to Permanent Coverage

Most individually owned term life insurance policies offer a conversion option that allows you to exchange your term insurance to permanent life insurance. If you pay your mortgage balance off and still require life insurance, you could choose to switch to permanent insurance without having to go through a new underwriting approval.

Your one-stop online guide for life insurance quotes. Get free quotes now!

Secured with SHA-256 Encryption

Is Term Insurance the Only

Life Insurance Option?

Because of its affordability and flexibility in various term lengths, most people will find that term life insurance will be their best option for mortgage life insurance. However, it is not the only available option when it comes to mortgage protection life insurance.

The following insurance options listed below can all provide an excellent source of protecting mortgage payments. Some of these options can also provide protection while you’re living, so they are not all necessarily life insurance policies.

Permanent Life Insurance with Cash Value

Permanent life insurance options such as whole life insurance and universal life insurance not only provide a lifetime of protection but also can accumulate cash value growth. (For more information, read our “Universal Life Insurance: How it Works, Options, Pros & Cons“).

Premiums payments are often locked in for the life of the contract, and if needed, you can access your cash value through loans should you need money to cover your mortgage payments.

Return of Premium Term Insurance

Most mortgage loans tend to last anywhere from 20 to 30 years long. For this reason, it makes perfect sense to match the length of your term insurance to the duration it takes to pay off your mortgage.

A 20 or 30-year term length can easily get the job done. However, a second option worth considering is a 20 or 30-year return of premium policy. An ROP policy is a regular term insurance contract with a rider attached, which guarantees a full refund of 100% of every premium payment returned to you, tax-free.

Just a quick note about ROP life insurance.

Many insurance companies have done away with offering this type of coverage. At one point, there used to be well over a half dozen insurance companies offering a return of premium term option. Over the last few years, the coverage option has dwindled to a few companies providing the coverage option.

We currently offer the small remaining companies that are still offering the insurance option. ROP is excellent for young adults, especially first time home buyers. If you like the idea of investing in life insurance and getting all your money back when it ends, don’t hold off as it may not be available soon.

Term Insurance with Living Benefits

When it comes to life insurance, most people believe that it only pays out if you die. While it is true that life insurance pays when you die, it can also pay while you’re living.

Several life insurance policies now include living benefits with their life insurance coverage. A living benefit allows you to access the death benefit while you’re living should you become sick with a chronic, critical, or terminal illness.

For example, if you suffer from an unexpected heart attack that would result in some time off of work, the critical illness living benefit could advance a portion of the death benefit to help pay for bills such as the mortgage payment.

Decreasing Term Insurance

QUICK NOTE

The decreasing term insurance referenced here is in regards to individually owned policies and not MPI policies. Individually sold decreasing term insurance policies were popular in the 80s and 90s but have been phased out over time.

Although not as common and widely accessible as it was in the past, some term insurance policies can offer a decreasing death benefit otherwise known as “decreasing term insurance”.

Whereas a traditional term insurance policy provides a level death benefit throughout the entire term contract, a decreasing term policy has a death benefit that reduces at specific policy anniversary years.

Decreasing term insurance sounds like the perfect mortgage life insurance policy however, it has been phased out by many insurance companies. A large reason for this is because traditional term insurance in itself is already affordable. You can also easily decrease the death benefit on a traditional term policy without having to go through any new underwriting which would also lower your premium.

If you choose to decrease your death benefit to match your mortgage payoff, your life insurance premium will also be reduced. It just makes more sense to purchase traditional term insurance when it comes to a mortgage life insurance policy.

Read more: Top Life Insurance Company That Sells Decreasing Term Life Insurance

Critical & Cancer Illness Standalone Policy

What if your life insurance doesn’t offer critical or cancer benefits?

An unexpected illness such as a stroke, heart attack or cancer can cause a massive financial burden on a family. It often creates time away from work which leads to no income coming in. Your mortgage payment may very well be the largest monthly bill you and your family will have.

If you have a life insurance policy that does not offer living benefit features, consider looking into a standalone critical illness and cancer plan.

Many insurance companies, such as Mutual of Omaha, offer affordable standalone critical illness and cancer policies that can provide a source of income if you should fall ill to a serious illness preventing you from going to work.

Disability Insurance Standalone Policy

Your ability to perform your daily duties at your workplace is how you earn your paycheck. What would happen if you were to become injured and needed to take time off of work? Would you need to dip into your savings or borrow from your retirement account to pay the bills?

An insurance option that helps protect you against this is disability insurance. A disability plan provides a monthly stream of income should you become injured and are unable to go to work.

In some cases, a disability insurance policy will also pay if you suffer from a medical illness and are unable to go to work, so it doesn’t necessarily have to be a bodily injury to receive payments.

A standalone disability insurance policy can be a bit costly. If you’re looking for an affordable alternative, consider a term life insurance policy with a monthly disability income rider.

A few popular life insurance plans such as Assurity and Transamerica can offer you death benefit protection, living benefits, and disability protection all within a term life insurance policy.

Does Your Existing Life Insurance Plan Provide Mortgage Protection?

If you currently have an existing life insurance policy, whether it’s an individually owned or an employer-provided plan, is it enough to cover your mortgage?

One of the best ways to find out is by doing a simple life insurance policy review. Life, in general, is unpredictable, and therefore planning for the exact amount of life insurance to have throughout your life is near impossible.

Life insurance calculators can do an excellent job of providing a close to an accurate amount, but they cannot predict the future.

Life events such as additional children, job promotions, career changes, health improvements, or the purchase of a new home can all raise the need for additional life insurance coverage.

To fully protect your family, you want to be sure that you have enough life insurance to cover your mortgage as well as any expenses related to the death of a breadwinner.

If your life insurance needs have changed since the purchase of your original life insurance coverage, consider laddering your existing policy with a new policy.

Laddering life insurance allows you to strategically plan for different life insurance needs through the use of multiple term life insurance policies with different death benefit amounts.

Remember, term life insurance comes in multiple contract lengths, which is why the laddering method works best with term insurance. As specific life insurance needs diminish over time, so do the life insurance contracts.

How to get the

Best Mortgage Life Insurance Policy

A mortgage life insurance policy is an important purchase. The plan you choose will provide your family with the funds needed to continue with making monthly mortgage payments should you pass away.

However, obtaining a mortgage life insurance policy is not as simple as just picking any company and automatically getting the coverage.

There are plenty of life insurance companies to choose from, but finding a one that can meet all your needs can be a little tough to do on your own.

One of the best ways to purchase life insurance is through the help of an independent life insurance agent. Most independent agents or agencies are generally contracted with multiple companies.

Working with an independent organization will remove a significant amount of time researching different companies and plans. Most of all, if you have health concerns, an independent agent will have the knowledge in which companies will be most favorable to those health conditions, resulting in getting you the best rate for your coverage.

Tips for Choosing an Affordable Mortage Life Insurance Plan

When you are ready to purchase a mortgage life insurance plan, there are a few tips we can offer to help you with, especially if you’re looking for the most affordable option.

Tip #1. Stick to Term Life Insurance

Although permanent life insurance is an option, term insurance will be the most affordable, especially for first time home buyers. According to a 2019 survey conducted by the National Association of Realtors, the median age of first time home buyers was age 33 while the median age for all home buyers was 47.

The median age for first time home buyers, along with the median age for all home buyers, are both young enough to where life insurance needs are high. Mortgage protection is just one of the many needs that may need to be covered by a life insurance policy.

It’s not out of the normal for most young families to need up to a million dollar life insurance policy to cover these needs. A million dollar term life insurance policy for 30 years for a 33 year old healthy male would cost just $59.28 per month. Whole life insurance, on the other hand, would cost $648.38 per month.

As you can see, whole life insurance is 11x more expensive than a term life insurance policy and for most families, not the most viable option.

Tip #2. Consider No Medical Exam

Most people are under the impression that when you apply for life insurance, you will need to take a medical exam. While this is still true, several companies offer the option to apply for coverage without having to take a medical exam at all.

For healthy people between the ages of 18-65, a no medical exam term life insurance policy can offer rates that are just as competitive or better than a company requiring you to take an exam.

Best of all, outside of not having to take an exam, approval can often be made as fast as a few days.

Tip #3. Ask About Conversion Options

When you purchase term insurance, the rate for coverage is locked in for the entire contract length. For example, if your term length is for 30 years, your rate is guaranteed to stay the same price until after the 30th policy year.

After the 30th policy year, you have the option to either let the policy lapse, continue making payments, but at an expensive rate or a third option, convert to a permanent plan.

Most reputable term life insurance products offer a conversion privilege that allows you to exchange your term coverage into permanent protection without any evidence of insurability.

Although the rate will be higher considering you are switching from term to permanent, a conversion option can become very beneficial to individuals who still need to continue life insurance protection but may have has health changes throughout the past years.

Tip #4. Check Company Ratings

If you find a mortgage life insurance plan that is affordable and has the best features for your situation, it’s always a good idea to check the insurance company’s financial strength rating before purchasing.

Several professional rating institutions offer this service, such as Standard and Poor’s, AM Best, and Fitch Ratings.

Ratings provide helpful insight for consumers in understanding an insurance companies financial outlook and claims-paying ability to their customers. When purchasing life insurance, look for ratings of an (A) or higher as these are signs of secure and financially stable companies.

Your one-stop online guide for life insurance quotes. Get free quotes now!

Secured with SHA-256 Encryption

Top 5 Best Mortgage Life Insurance Plans in 2020

Most companies that offer a term life insurance plan will be capable of providing mortgage protection. However, we would like to shine the spotlight on specifically five companies that we believe are offering the best mortgage life insurance coverage in 2020.

AIG American General

With AIG Select-A-Term, you have the option to choose from 18 different term durations, including a 35 year option. Also, AIG term life insurance plans provide a conversion option that allows you to exchange the term coverage to permanent coverage.

Select-A-Term from AIG could very well be one of the best mortgage protection insurance plans. It’s unique term durations allow you to precisely cover all life insurance needs through laddering multiple policies.

LEARN MORE: Read our full AIG American General Review.

Assurity

The no medical exam option offered with Assurity term insurance is just one reason that makes the coverage best for mortgage protection. Assurity is one of a few companies to provide a return of premium feature on both it’s 20 and 30 year term lengths.

Additional features can be added to the term coverage at an additional cost such as a critical illness benefit rider, children term protection, and monthly disability income rider.

LEARN MORE: Read our full Assurity Life Insurance Review.

Banner Life

The 35 and 40 year term duration is not just the only reason that makes Banner Life a consideration for the best mortgage protection insurance company. The insurance company also offers an optional rider that is called “Term Riders.”

Term Riders works by letting you stack additional term lengths to an existing term contract such as a 30 or 40 year policy. It provides a fully customizable plan to structuring your coverage to meet life’s changing needs under one plan rather than having multiple policies.

Banner Life’s Term Riders is the closest option to a decreasing term life insurance policy. As the riders kick in, your death benefit it reduced along with your premiums payments. You also have the option to convert your policy should insurance needs change later in life.

LEARN MORE: Read our full Banner Life Insurance Review.

Pacific Life

PL Promise Term does not offer any special features or policy riders that stand out, but the term insurance coverage is priced very well among its competitor’s term products.

A well-priced term life insurance policy is not the main reason why Pacific Life has made our list for the best mortgage protection. Although it helps, the main reason why we have nominated Pacific Life is for seniors.

Seniors who may have purchased a new home later in life and that are interested in protecting their mortgage will find PL Promise Term an excellent option. PL Promise Term does not require applicants who are between the ages of 50-69 and that are needing a million dollars or less in coverage to take a medical exam.

As long as you have had a comprehensive medical exam with blood work within the last 18 months, Pacific Life will waive the medical exam.

LEARN MORE: Read our full Pacific Life Insurance Review.

Protective

The insurance plan works similar to term insurance in the sense that you start by choosing a term length of either 10, 15, 20, 25, or 30 years. Just like a term life insurance policy, the premiums are locked in for the entire duration of the term length you choose.

Where Custom Choice UL becomes interesting, and the main reason why we named them as a top choice for mortgage protection is what happens when the term duration expires. Once the level term period ends, Custom Choice automatically turns into universal life insurance with a decreasing death benefit, all of which requires no new evidence of insurability.

You will be able to continue making the same premium payments as you were, but the death benefit will decrease each anniversary year until it reaches a minimum of $10,000. Having this feature can be an affordable alternative to converting into permanent life insurance, especially if you have had health changes since the time you initially purchased the contract.

LEARN MORE: Read our full Protective Life Insurance Review.

Reputable Mortgage Protection Insurance Companies

Listed above are five companies that we consider to be the best option when it comes to life insurance and protecting your mortgage.

With that said, they are not your only option, and there a plenty of reputable life insurance companies that can offer an excellent term life insurance product.

Below is a list of some of the best term life insurance companies in 2020.

- ANICO

- ASSURITY

- CINCINNATI LIFE

- FORESTERS

- JOHN HANCOCK

- LINCOLN FINANCIAL

- MINNESOTA LIFE (SECURIAN)

- MUTUAL OF OMAHA

- NORTH AMERICAN

- PRINCIPAL

- PRUDENTIAL

- SAGICOR

- SBLI

- SYMETRA

- TRANSAMERICA

Mortgage Protection Insurance or Mortgage Life Insurance: Conclusion & Recap

There are only a few situations where you would benefit from the limited scope and features of mortgage protection insurance.

If you have poor health or a medical condition that precludes you from obtaining mortgage life insurance, MPI may be the best way to protect your family from the financial burden of mortgage payments.

Read more: What to Do When a Family Member or Loved One Dies

In most cases, the insurance company pays the benefits directly to your mortgage lender, so your family doesn’t see any of the money.

Remember that mortgage protection insurance (MPI) is entirely different from private mortgage insurance (PMI), which covers your mortgage lender, not you.

MPI plans are usually considerably more expensive than mortgage life insurance plans because they don’t require a medical exam. If you’re in good health and can obtain mortgage life insurance, you probably don’t need mortgage protection insurance.

If you don’t qualify for term life insurance or mortgage life insurance, look for an MPI plan that will allow you to convert the coverage when your mortgage is paid off. Make sure the policy covers more than just accidental death.

Also, look for a policy with level death benefits, level premiums, returned premiums, or some combination of the above that will best suit your situation. Lastly, make sure the insurance company you’re considering purchasing your plan from has an excellent rating with one or more of the major rating companies.

Ready to Compare Life Insurance Rates?

It’s free, fast and super simple.

Looking to compare life insurance prices? We can help. Enter your ZIP code to get free quotes from multiple insurers.

Your one-stop online guide for life insurance quotes. Get free quotes now!

Secured with SHA-256 Encryption

Mathew B. Sims

Editor-in-Chief

Mathew B. Sims is Editor-in-Chief and has authored, edited, and contributed to several books. He has been working in the insurance industry ensuring content is accurate for consumers who are searching for the best policies and rates. He has also been featured on sites like UpJourney.

Editor-in-Chief

Editorial Guidelines: We are a free online resource for anyone interested in learning more about life insurance. Our goal is to be an objective, third-party resource for everything life insurance-related. We update our site regularly, and all content is reviewed by life insurance experts.