Can You Own Multiple Life Insurance Policies?

Free Life Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Leslie Kasperowicz

Farmers CSR for 4 Years

Leslie Kasperowicz holds a BA in Social Sciences from the University of Winnipeg. She spent several years as a Farmers Insurance CSR, gaining a solid understanding of insurance products including home, life, auto, and commercial and working directly with insurance customers to understand their needs. She has since used that knowledge in her more than ten years as a writer, largely in the insur...

Farmers CSR for 4 Years

UPDATED: Mar 22, 2024

It’s all about you. We want to help you make the right life insurance coverage choices.

Advertiser Disclosure: We strive to help you make confident life insurance decisions. Comparison shopping should be easy. We are not affiliated with any one life insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different life insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about life insurance. Our goal is to be an objective, third-party resource for everything life insurance-related. We update our site regularly, and all content is reviewed by life insurance experts.

UPDATED: Mar 22, 2024

It’s all about you. We want to help you make the right life insurance coverage choices.

Advertiser Disclosure: We strive to help you make confident life insurance decisions. Comparison shopping should be easy. We are not affiliated with any one life insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different life insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

You can absolutely have multiple life insurance policies. Anyone can, and most people do. In this article, you’ll discover everything you need to know about owning more than one life insurance policy.

We will teach you about the pros and cons, who can benefit most, and how to go about purchasing multiple plans. Plus, we’ll also discuss the benefits of mixing different types of insurance, such as term and permanent plans, as well as how life events can determine or alter your need for coverage.

Looking to compare life insurance rates for free? Enter your ZIP code to get multiple quotes.

Is It Legal to Have Multiple Life Insurance Policies?

Best Companies for Multiple Life Insurance Policies

| Best MLP Companies | AM Best Rating | Type of Coverage | Eligible Ages | Coverage Amounts | Policy Features | Additional Info |

|---|---|---|---|---|---|---|

| AIG | A | Term Insurance | 20-80 | $100,000 - $1,000,000+ | 18 Different Term Lengths | Learn More |

| Assurity | A- | Term Insurance | 18-75 | $25,000 - $1,000,000+ | Return of Premium | Learn More |

| Banner | A+ | Term Insurance | 20-75 | $100,000 - $1,000,000+ | 40 Year Term Lengths | Learn More |

| Protective | A+ | Term & Universal Blend | 18-75 | $1,00,000 - $1,000,000+ | Decreasing Death Benefit | Learn More |

| Transamerica | A+ | Term Insurance | 18-80 | $25,000 - $1,000,000+ | Living Benefits | Learn More |

This is a pretty common question with a straightforward answer. The truth is that it’s legal to have multiple life insurance policies. It often benefits many people and their families.

The only limit on how many life insurance policies you can have comes down to your health, your coverage needs, and what insurers call a financial justification. But even then, there’s a lot of room for flexibility.

What is Financial Justification for Life Insurance?

Insurance companies look for financial justification when processing any application for life insurance. Essentially this just means that they’re checking to make sure that the total amount of life insurance you’re applying for is appropriate.

Life insurance exists as an excellent way to provide financial protection to your loved ones should you unexpectedly pass away. However, this does not mean you can choose any random amount of protection. Life insurance cannot be purchased as a means for your loved ones to profit from your passing financially.

As an example, let’s say you are a 50-year-old married male with one child who is 18 years old. You have an annual income of $50,000 and are considering $2,500,000 in coverage.

Trying to justify the need for $2,500,000 of coverage based on an annual income of $50,000 and a child who is close to being an adult would be a difficult case to make for needing so much coverage.

How do you know if your life insurance request meets financial justification?

To determine if the amount of coverage you want to purchase to protect your family will qualify for financial justification, a good rule of thumb is to multiply your income by 10. Most insurance companies will allow up to 10x your annual income worth of coverage if you are between the ages of 18-65 without questioning financial justification.

Younger applicants between the ages of 18-40 who are purchasing their first home or having their first child will often have the highest need for life insurance. Life insurance companies also understand that higher life insurance needs will result in much more than 10x annual income worth of life insurance coverage.

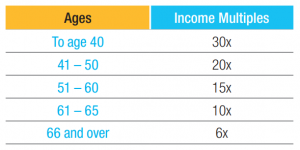

For this reason, insurance companies will allow for a higher multiplier of income based on younger age groups. Every life insurance uses its own set of financial justification guidelines, but all are relatively close if not the same.

As an example, below is a look at Protective Life’s financial justification guidelines, also referred to as an income replacement multiplier.

To determine the maximum amount of coverage, an insurance company will allow based on financial guidelines, simply look at your age group and multiply your annual pre-tax income with the corresponding multiplier.

It’s crucial that if you are considering multiple life insurance policies, financial justification also counts towards the total amount of life insurance coverage you currently have active. It is not just based on a per-policy basis.

Insurance companies will require you to disclose on your application all current life insurance coverage you actively have, including the type of coverage, total amount, and whether or not you intend to replace the existing coverage.

Replacing existing coverage or coverage you have through your workplace will not count towards your overall request for new life insurance. However, if you do have any personally owned life insurance coverage that will not be replaced, that amount will need to be added to your multiple life insurance plan.

Your one-stop online guide for life insurance quotes. Get free quotes now!

Secured with SHA-256 Encryption

Who Would Benefit From Multiple Life Insurance Policies?

Many people already own some form of life insurance coverage. The most common type is often through an employer-provided plan or even one that may have been purchased by their parents when they were a child. There may also be a chance that you currently own a personal plan purchased several years ago.

The issue, and what mostly requires the need for multiple life insurance policies is an increased need for additional coverage. Employer-provided plans, old childhood plans, and individually owned plans may no longer be able to provide enough coverage to keep up with life’s ever-changing needs.

Top Reasons for Additional Life Insurance Coverage

- Increase in income

- Change in marital status

- Additional dependents

- Purchase of a home

- Career change

- Change in health

If you need more coverage, shouldn’t you start all over with a new policy?

The answer will depend on the individual. The nature of the insurance business is such that sometimes the best choice for coverage is multiple life insurance policies, as opposed to canceling an existing policy for a new one. The main reason for this? Cost.

Obviously you want to get the best deal on your life insurance— and continue getting the best deal for the most coverage throughout your life. But canceling a policy can be cost-prohibitive, especially if your current coverage is already affordable. This is why it’s common for people to layer or ladder their life insurance policies.

Laddering and Layering Life Insurance

Just so you’re clear, having multiple life insurance policies is often called laddering life insurance or layering term insurance. They all essentially mean the same thing. So, the next time you hear or read about laddering life insurance, you know they’re talking about multiple policies.

To give you a better idea, here are a couple of examples of how layering and laddering life insurance policies work.

Layering and Laddering Life Insurance: Structuring Term Lengths

Most people incur the highest amount of debts when they’re young and generally pay off those debts as they get older. This is a basic premise of layering or laddering life insurance.

Say you’re 33 years old and healthy, and you’re planning your future with your spouse. You have a mortgage and plan on having two kids. You look into buying life insurance coverage to cover your mortgage, help raise your kids, provide college tuition, pay for funeral expenses, car payments, and other everyday expenses.

You can do this in one of two ways.

Option One:

The first option does not require multiple policies but rather just one single policy. It would require you to buy one long-term life insurance policy with a large death benefit, say, $1,000,000 for a 30-year term length.

The 30 year term policy would provide $1,000,000 of coverage along with a fixed rate for the next thirty years. However, when you crunch the numbers, you realize that your annual cost for coverage will be $990.

When multiplied over the entire duration of the contract, you will end up paying approximately $29,700 over the life of the policy.

But, since you and your spouse plan on saving a percentage of your income every month, paying off your mortgage in 20 years, and maxing out your respective 401(k)’s, you won’t need the full $1,000,000 in 30 years.

This leads us to option two, which utilizes multiple life insurance policies.

Option Two:

The second option involves strategically structuring multiple term life insurance policies to cover important life insurance needs until they are no longer a need.

Rather than purchasing one entire term policy, instead, you run the numbers on what it would cost to purchase three different policies, all with varying lengths of term and death benefits.

- 10-year policy for $500,000 (Annual Premium $155 x 10 years = $1,550)

- 20-year policy for $300,000 (Annual Premium $172 x 20 years = $3,432)

- 30-year policy for $200,000 (Annual Premium $205 x 30 years = $6,164)

You see that laddering your life insurance coverage like this will cost a total of $11,146 versus $29,700 for one large policy. The multiple policy method would save you approximately $18,553 over 30 years.

Remember, life insurance needs tend to be at their highest in younger years and often lessen as you get older. For this reason, it may not make financial sense to keep such a high valued policy for the next thirty years.

If multiple life insurance policies make better sense, you will want to make sure your shortest term duration offers the most amount of death benefit.

As time goes by, life insurance needs such as mortgage protection, funds for your child’s education, and overall debts should either lessen or no longer be needed. As those needs decrease, your term insurance contracts should terminate as there will not be a need for them.

Term layering insurance policies can become a little overwhelming to do on your own. We will admit that it’s not as simple as purchasing one policy with one death benefit.

Therefore, if you are considering a multiple life insurance policy structure, we recommend using the help of a life insurance agent. An experienced agent will be able to do a simple review and discuss current and future life insurance needs.

If you’re in the early stages and would like to do some research on your own, we also recommend using the help of a life insurance needs calculator.

A needs calculator is a simple tool created to help with overall life insurance planning. It will help you discover potential life insurance needs as well as an accurate amount of coverage you should consider.

Read more: Mortgage Protection Insurance vs. Mortgage Life Insurance

Layering and Laddering Life Insurance: Stacking Death Benefits

The second layering and laddering method focuses on stacking multiple life insurance policies to achieve an overall death benefit amount.

The method primarily works for life insurance policies that offer a maximum limit on the total amount of coverage you can obtain on one single policy.

These types of life insurance policies are commonly associated with no medical exam plans, both term and permanent, as well as burial insurance plans.

No Medical Exam life insurance provides the same features and protection as any traditional term or permanent life insurance plan. The main difference is that some of these plans may not require you to complete a medical exam as part of the application process.

No medical exam life insurance plans have become increasingly popular over the last few years. Mostly because you do not need to schedule a time to meet with an examiner, do blood work, provide a urinalysis, or even have your blood pressure taken.

However, this is not the only main reason. No medical exam policies can offer fast approval and rates are just as competitive if not better than a policy that would typically require you to take a medical exam.

The issue with no medical exam plans is with the total amount of coverage you can get under one single policy. Whereas a policy that requires a medical exam will allow you to apply for as much coverage as you need (as long as it’s within financial justification), no exam policies are limited.

Most no exam policies offer a maximum coverage amount that can range anywhere from $250,000 to $1,000,000 depending on the insurance company providing the coverage. This can be a problem if your life insurance needs are higher than what is available with a company’s medical exam limits.

A solution to getting more coverage without having to take a medical exam would be to apply with two or more companies offering no medical exam coverage.

Example: Say you want to get a $2 million dollar no-exam term life insurance policy, but you can’t find a company that offers that much coverage without having to take an exam. In this situation, you would want to seek two separate $1,000,000 no exam policies with two different companies.

It should also be noted the structuring term lengths along with stacking death benefits works well with no medical exam term insurance plan. Remember, no exam term insurance is no different than traditional term insurance that requires a medical exam. You will have the option to choose from multiple contract lengths to structure the perfect life insurance plan.

Burial Insurance plans are a form of whole life insurance. The insurance coverage does not require a medical exam and offers limited death benefits that typically range from $2,000 up to a maximum of $50,000. These plans do not require a medical exam. They are often purchased by seniors who do not need a significant amount of coverage and are just looking to cover funeral costs and other small remaining debts. Since the coverage is limited, it’s not uncommon for seniors to require multiple policies to achieve the overall coverage they need.

Guaranteed Issue plans are not much different from burial insurance plans. In fact, guaranteed issue life insurance can be classified as a form of burial insurance. The most significant difference between the two comes down to qualification.

Although burial insurance and guaranteed issue both require no medical exams, burial insurance does require approval based on answers to medical questions. Guaranteed issue requires no questions about your medical history at all.

Coverage, however, is often limited to $2,000 up to a maximum of $25,000. Guaranteed issue policies are often a suitable option for people with high-risk health conditions that would otherwise not qualify for traditional life insurance.

Since the death benefit is limited on these plans to $25,000, it is not uncommon to need to stack multiple policies.

Changing the Death Benefit On Your Life Insurance Policy

Now, you may be wondering why wouldn’t you just get a long term contract length like a 30 of 40-year plan or even a permanent life insurance policy and increase or decrease the death benefit as your insurance needs change? (For more information, read our “40-Year Term Life Insurance“).

The truth is that most companies will only allow you to decrease coverage as your insurance needs lessen. Increases in the death benefit of existing policy are typically not allowed. There is no clear answer as to why not, but we believe it’s because it is not profitable to the insurance company.

When changes such as decreases in coverage are to occur, the new price for the coverage is based on the age when you originally purchased the coverage and not the age you would be at the time of the change.

Keep in mind, insurance rates are based on several underwriting factors, with age being one of the largest. If you were to increase your death benefit on the same policy ten years into the policy, the insurance company would lose out as they would need to backdate your age to when you initially took out the policy.

Therefore, insurance companies do not allow increases in coverage after the policy has been issued, only decreases.

Changes you can make to a life insurance policy after it has been active

- Name

- Address

- Beneficiary

- Banking

- Payment Mode

- Death Benefit (Decreases Only)

If you can decrease the death benefit of a life insurance policy, you wouldn’t necessarily need to layer or ladder your coverage with multiple policies, right?

It’s possible you may not need multiple policies if your coverage is large enough to make decreases as your life insurance needs change. However, a few issues could arise if you needed to increase your death benefit for any reason.

Should you choose to decrease your death benefit, you will never be able to increase it later down the road. Unexpected expenses, such as another child, or the purchase of a second house or property, could require you to need additional coverage.

If this were to happen, and if it required the need for extra coverage, you would need to go through the entire underwriting process again to get a new policy. Keep in mind, your premium will be higher than if you were to have not decreased your death benefit in the first place or if you would have originally purchased multiple policies.

Another potential issue with decreasing a death benefit comes with your originally approved health classification. In most cases, reducing your coverage will not have any adverse effects.

However, a potential issue could arise if you lower the coverage under $100,000. Most insurance companies only offer “standard rates” when the death benefit is less than $100,000, even if you originally qualified for preferred rates.

Your one-stop online guide for life insurance quotes. Get free quotes now!

Secured with SHA-256 Encryption

Multiple Policy Discounts

A common question that we often get from husband and wife applicants is whether or not there is a multi-policy discount if they both apply for coverage at the same time. Unfortunately with the exception of a very few final expense policies, most insurance companies do not offer a multi-policy discount for husband and wife applicants.

Some insurers, however, will waive policy fees for people applying for two life insurance policies from the same company. Most commonly these are Annual Policy fees, which run between $30 and $70 a year. While this isn’t a huge number, it does add up over time.

Whole Life and Term Life Insurance: Can You Have Both?

Not only can you have both whole life and term life insurance at the same time, but it can also be an excellent idea to combine the two if the finances make sense.

As the name suggests, whole life insurance, sometimes called permanent life insurance, lasts for your entire lifetime. Whether you’re 25 or 75, it is guaranteed to pay out the full amount to your beneficiaries when you die.

Term life insurance, on the other hand, only lasts for a certain number of years and only pays out if you die during the term of the policy.

As you can probably guess, whole life insurance is much more expensive than term life insurance. The biggest reason for this is that whole life insurers know that they will be paying out the death benefit eventually.

With term insurance, most people aren’t expected to die within the term of the policy. Some rare term life policies offer the return of premiums when the policy expires if the insured is still alive. However, these policies tend to be more expensive than their standard counterparts.

Since whole life is more expensive, people often buy a term life policy for added coverage. This tactic is especially helpful for young families when you’re paying for kids to go through college or paying off a mortgage.

You can purchase a term life policy that lasts until the college and mortgage are paid off. This makes sure your family won’t be unduly burdened if something happens to you during that time.

Most term insurance policies also offer conversion options. This means you will have the opportunity to automatically switch your term coverage into permanent coverage without having to go through a new underwriting process.

Another form of permanent life insurance that works well in combination with term insurance is guaranteed universal life insurance. The insurance coverage is an affordable alternative to whole life insurance as it does not focus on cash value growth but just permanent life insurance protection.

Read more: Understanding Cash Value Life Insurance Pros and Cons

Other Reasons to Own Multiple Life Insurance Policies

While saving money & being able to structure the best life insurance plan ultimately are the two biggest reasons to have more than one life insurance policy, there are several other reasons to consider multiple coverages.

All the other reasons for different policies fall under the “life is unpredictable” heading. Here are some examples of the curve balls life can throw at you.

Loss of a Job

If you have group life insurance through your employer, it can be a good move to get another policy privately. This is if your employer provides enough coverage in the first place, which many don’t.

Another policy can help to ensure that you’ll at least have some coverage if you lose the job. This way, if something happens to you before you find another job, your family will still be covered through your privately-purchased insurance.

A Recession or Unexpected Financial Burden

It’s impossible to see into the future. No one knows when the next recession will hit or when something will happen in their life that puts a big dent in their savings or investments.

The sudden loss of a 401(k) or IRA can be rattling, but having life insurance can be the safety net your family needs if something happens to you. In these situations, it’s better to have some coverage than none at all.

Policies that Help When You’re Sick

Life insurance pays out a death benefit to your beneficiary or beneficiaries when you pass away. If you have the right kind of life insurance it can also pay when you get sick.

The policy we are referring to is called life insurance with living benefits. It is a newer type of life insurance coverage that can pay due to a qualifying chronic, critical, or terminal illness.

A living benefits policy not only provides financial protection while you’re living, but it also provides death benefit protection to your family should you pass away.

If you have a traditional life insurance policy that does not offer these features, consider a multiple life insurance plans that includes living benefits.

Divorce

A divorce can be a rough and stressful time especially when children are involved. As you already know, a divorce doesn’t mean that you stop providing for your children.

Oftentimes when children are involved part of the divorce settlement requires the parents to have life insurance until the youngest child has reached 18 years of age.

Multiple life insurance policies can become beneficial should you remarry and require a policy to protect your new spouse, stepchildren, and any future children.

A Failing Insurance Company

While this one is very rare, it’s not out of the realm of possibility. Having life insurance policies from multiple companies is a good way to plan for the worst. If one insurance company goes under, you’ll still have coverage from another.

Just to provide you peace of mind, if a life insurance company does go under, it’s generally purchased by another company, and client coverage is unaffected by the buyout. We are not aware of any major life insurance company ever failing and leaving their clients left without coverage.

Your one-stop online guide for life insurance quotes. Get free quotes now!

Secured with SHA-256 Encryption

Consequences of Not Having Enough Life Insurance

A death in the family is hard enough in itself, the last thing you want is to leave your loved ones in a poor financial situation. The proper amount of life insurance will ensure that your family members have enough money to cover expenses.

Such as funeral costs, mortgage payments, car payments, and college tuition. The death of a breadwinner shouldn’t mean that your family has to sell the house or stop bettering their lives through education. This is why having enough life insurance is important.

Beware Employer-Sponsored Group Life Insurance

Many people sign up for their employer-sponsored group life insurance plans because they are often affordable. Then they check life insurance off of their list of things to do. But often, employer life insurance doesn’t provide your family with much protection, and it’s rarely transferable if you leave the job.

Most employer group life insurance programs offer coverage at 1-5 times your annual salary. This is better than nothing, but when you consider that most experts suggest somewhere between 10-15 times your salary as a rule of thumb, you begin to see where the problem is.

If you have group life insurance through your employer, it can be an excellent move to get another policy privately. Employer-provided coverage is often very affordable, but it’s generally not enough.

An individually owned policy can help to ensure that you’ll at least have some coverage if you lose your job, and your group insurance is not transferable. This way, if something happens to you before you find another job, your family will still be covered through your individually owned life insurance policy.

Disclosing Your Current Coverage When Applying for Life Insurance

An important reminder: don’t forget to disclose your existing coverage when applying for multiple life insurance policies. As mentioned above, insurance companies communicate with each other to make sure they aren’t over-insuring individuals.

You’ll want to tell how much coverage you already have, even if it’s free through your employer. Be prepared to explain why you want additional coverage. Insurers want financial justification.

The same goes for applying for two different policies at the same time with two different companies. You can absolutely do this but you need to disclose the companies, type of coverage and amount of coverage you are applying for with all life insurance companies.

Best Life Insurance Companies for Owning Multiple Policies

Regardless if you are purchasing one or multiple life insurance policies, it is an important purchase. Choosing a company that will be providing your family with valuable protection for the next several years can be a tough decision to make on your own.

If you’re new to life insurance you will quickly realize that you have many coverage options to choose from. The best way to go about the process is to do your research, utilize the internet, and don’t be afraid to ask for help.

Ideally, we recommend that you work with an independent agent or agency that can offer you multiple insurance companies. Captive agencies such as State Farm or Farmers Insurance may offer excellent coverage options, but they only offer their products which are not always the best option.

Read more: Life Insurance Agents: Independent vs Captive

An independent agency that is contracted with multiple companies will be able to shop your coverage for features that are tailored to your needs. If you have health issues, they will also be able to fit you with the best company with favorable underwriting towards those health issues.

If you’re considering a multiple life insurance structure plan, we would like to help you by recommending our top five best companies for this type of planning. All our recommended life insurance companies have an AM Best rating or an (A) or better each with a long history within the insurance industry.

Top 5 Best Multiple Life Insurance Policy Options

- AIG

- Assurity

- Banner Life

- Protective

- Transamerica

Your one-stop online guide for life insurance quotes. Get free quotes now!

Secured with SHA-256 Encryption

AIG

Term insurance contracts are easily available in 10, 15, 20, 25 & 30 years fixed premium lengths. However, AIG offers something a little different than the others and that is 18 different term durations including a 35 year policy with its Select-A-Term insurance plans.

With having as many contract lengths to choose from as you do with AIG, term structuring can be precise with multiple term policies.

LEARN MORE: Read our full AIG American General Review.

Assurity

The term insurance offered by Assurity requires no medical exam for applicants who are between the ages of 18-65 as long the death benefit amount is less than $500,000. Approval for coverage can be as quick as the same day, but on average, it’s often made within a week from applying.

In addition to lower death benefits and the opportunity to pass on having to take a medical exam, Assurity term insurance offers several optional policy riders. A few of those riders include a critical illness benefit rider and a monthly disability income rider. Both of these riders can pay a stream of monthly income if you become sick or injured and are unable to work.

Assurity also offers a policy rider that most companies do not, and that’s a return or premium option. If your multi insurance planning involves a 20 or 30 year term length, consider adding the return of premium rider. At the end of your term length, you will get 100% of every premium paid returned to you.

LEARN MORE: Read our full Assurity Life Insurance Review.

Banner

With OPTerm you have the option to choose a term length that will provide level protection throughout the entire contract length you choose. OPTerm also offers a policy rider called Term Riders that, when added to the base term policy it will turn your coverage into a decreasing death benefit policy.

The rider works by first selecting a term duration higher than 10 years, such as a 30 year policy. Then by adding the Term Rider feature, you can structure your death benefit to automatically decrease at 20, 15, or 10 year increments.

You don’t need to worry about calling into the company to make these changes as it’s all handled for you. The death benefit and premiums decrease as scheduled within your policy outline.

The Term Riders feature is only one great benefit offered by Banner Life. OPTerm is one of the first term insurance plans to offer a 35 and 40 year term contract length outside of the industry standard 30 year length.

LEARN MORE: Read our full Banner Life Insurance Review.

Your one-stop online guide for life insurance quotes. Get free quotes now!

Secured with SHA-256 Encryption

Protective

Protective Classic Choice, the company’s traditional term coverage, is the most affordable of the two options. In fact, if you’re shopping around for term quotes, there is a good chance Protective Classic Choice will be within the top three based on price.

The term insurance coverage is your all-around basic coverage. However, just announced in 2020, Protective added a 35 and 40 year term length option making them the second national life insurance company to offer a contract length that long.

The second term option offered by Protective Life is their Protective Custom Choice UL. The insurance coverage provides a blend of both term insurance features plus universal life insurance features.

The coverage works by selecting a term length of up to 30 years. Once your contract length ends, the coverage automatically turns into an annual decreasing death benefit until it reaches $10,000. Best of all, your premium payments continue to remain at the same price.

LEARN MORE: Read our full Protective Life Insurance Review.

Transamerica

The Trendsetter Super coverage by Transamerica can easily be named as the leader when it comes to term lengths and maximum ages.

What this means is that each term length has a maximum age cutoff that is set by the company offering coverage. Transamerica is known to provide a much higher maximum age cutoff from what most companies offer on comparable term lengths.

For example, a non-smoker age 58 can apply for a 30 year policy Transamerica Trendsetter term policy. Why does this matter? Because most companies have set the cutoff for a 30 year policy at age 55.

For this reason, Transamerica’s Trendsetter policies are ideal not only for young applicants but especially for older age applicants needing multiple life insurance policies with longer-term durations.

The second term policy offered by Transamerica is its Trendsetter Living Benefits coverage. As mentioned earlier, life insurance is not all about providing death benefit protection. Some policies can provide benefits while you’re alive, and Transamerica Living Benefits coverage does just that.

Trendsetter Living Benefits provides three built-in policy riders that can advance a significant portion of the policy’s death benefit if you were to come down with an unexpected critical, chronic, or terminal illness.

If you currently have existing life insurance coverage and are considering multiple life insurance plans, add a policy with living benefits.

Pros and Cons of Having Multiple Life Insurance Policies

To summarize, here are the pros and cons of having multiple life insurance policies.

| Pros | Cons |

|---|---|

| Most Effective Life Insurance Planning Strategy | Can Be An Added Expense |

| Can Save You Money | Can Be Expensive (If you have health conditions) |

| Can Provide Added Coverage If Your Needs Change | |

| Can be Combined with Term and Permanent Options | |

| Can Provide Added Coverage to Limited Employer Life Insurance | |

| Coverage Matches Needs as You Age | |

| Can Protect Your Family From Unexpected Financial Burdens | |

| Gives You Peace of Mind |

Conclusion

There’s absolutely nothing illegal about having more than one life insurance policy. You can mix and match: term life and whole life, multiple term life policies, employer-sponsored and term or whole life policies.

You can name the same beneficiaries in all of these policies if you wish or multiple beneficiaries provided there is an insurable interest.

Just remember to disclose your existing coverage when applying for new policies. And, know that insurance companies look for financial justifications to determine the correct coverage amount.

You may be able to save lots of money with multiple life insurance policies, depending on your situation, health status, income, and age. Since there are so many options out there, it’s best to get a quote from multiple companies, which you can do here.

Ready to Compare Life Insurance Rates?

It’s free, fast and super simple.

Looking to compare life insurance rates for free? Enter your ZIP code to get multiple quotes.

Your one-stop online guide for life insurance quotes. Get free quotes now!

Secured with SHA-256 Encryption

Leslie Kasperowicz

Farmers CSR for 4 Years

Leslie Kasperowicz holds a BA in Social Sciences from the University of Winnipeg. She spent several years as a Farmers Insurance CSR, gaining a solid understanding of insurance products including home, life, auto, and commercial and working directly with insurance customers to understand their needs. She has since used that knowledge in her more than ten years as a writer, largely in the insur...

Farmers CSR for 4 Years

Editorial Guidelines: We are a free online resource for anyone interested in learning more about life insurance. Our goal is to be an objective, third-party resource for everything life insurance-related. We update our site regularly, and all content is reviewed by life insurance experts.