Life Insurance Premiums: What are they & How are they Determined?

Free Life Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Leslie Kasperowicz

Farmers CSR for 4 Years

Leslie Kasperowicz holds a BA in Social Sciences from the University of Winnipeg. She spent several years as a Farmers Insurance CSR, gaining a solid understanding of insurance products including home, life, auto, and commercial and working directly with insurance customers to understand their needs. She has since used that knowledge in her more than ten years as a writer, largely in the insur...

Farmers CSR for 4 Years

UPDATED: Dec 4, 2023

It’s all about you. We want to help you make the right life insurance coverage choices.

Advertiser Disclosure: We strive to help you make confident life insurance decisions. Comparison shopping should be easy. We are not affiliated with any one life insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different life insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about life insurance. Our goal is to be an objective, third-party resource for everything life insurance-related. We update our site regularly, and all content is reviewed by life insurance experts.

UPDATED: Dec 4, 2023

It’s all about you. We want to help you make the right life insurance coverage choices.

Advertiser Disclosure: We strive to help you make confident life insurance decisions. Comparison shopping should be easy. We are not affiliated with any one life insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different life insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

Do you speak life insurance? While not technically its own language, it can feel like it if you’re unfamiliar with a few of the specific terms.

To help you, we’re breaking down a commonly-used piece of life insurance jargon: premiums. What are they, how much do they cost, and who has to pay them?

The answers to these questions can differ, depending on a few different variables. That’s why premiums, in general, can be a little confusing.

Ready to start learning about life insurance premiums? We’ve got your all-in-one guide below.

Looking to compare life insurance prices? We can help. Enter your ZIP code to get free quotes from multiple insurers.

What are Life Insurance Premiums?

This question is one that is a bit easier to answer. A life insurance premium is basically another name for the price or cost that is required to have the coverage.

The word premium is commonly used when dealing with payments that are associated with insurance policies. A few examples would be health insurance premiums, car insurance premiums, and even homeowners insurance premiums.

So in other words, when it comes to life insurance premiums, it is the payment that is required for the actual life insurance coverage.

When making premium payments, you’re paying the insurance company who is providing you with coverage. In return, you are provided with a cash benefit so that when it is needed, you or your family will have access to the benefits of the policy.

With life insurance, the insurance company makes a promise that as long as you make your premium payments, they will in return pay out a cash benefit (also referred to as the death benefit) to your named beneficiary should you pass away. This promise also comes in the form of a physical contract known as the life insurance policy.

How often and how long you pay premiums will depend on the type of life insurance plan you have. For example, a term life insurance policy has contract lengths in which coverage is purchased for a specific amount of years such as 10, 15, 20, 25 or 30 years.

So if you have a policy with a 30-year term contract, you’re only going to pay life insurance premiums during the course of thirty years.

There are also permanent life insurance plans such as universal life insurance or whole life insurance in which life insurance premiums will be required for life. This is unless you decide to make limited payments which can shorten the duration of premium payments on permanent life insurance plans.

Your one-stop online guide for life insurance quotes. Get free quotes now!

Secured with SHA-256 Encryption

How do Life Insurance Companies Calculate their Premiums?

This is where things can become a little bit confusing when discussing life insurance premiums. There is a difference between the life insurance company’s rates and the rate that the applicant will qualify for based on their qualification, which this article will discuss in greater detail shortly.

To make it as simple as possible, we will break it down into two sections beginning with how the life insurance companies determine their overall rates.

Have you received a quote for life insurance yet?

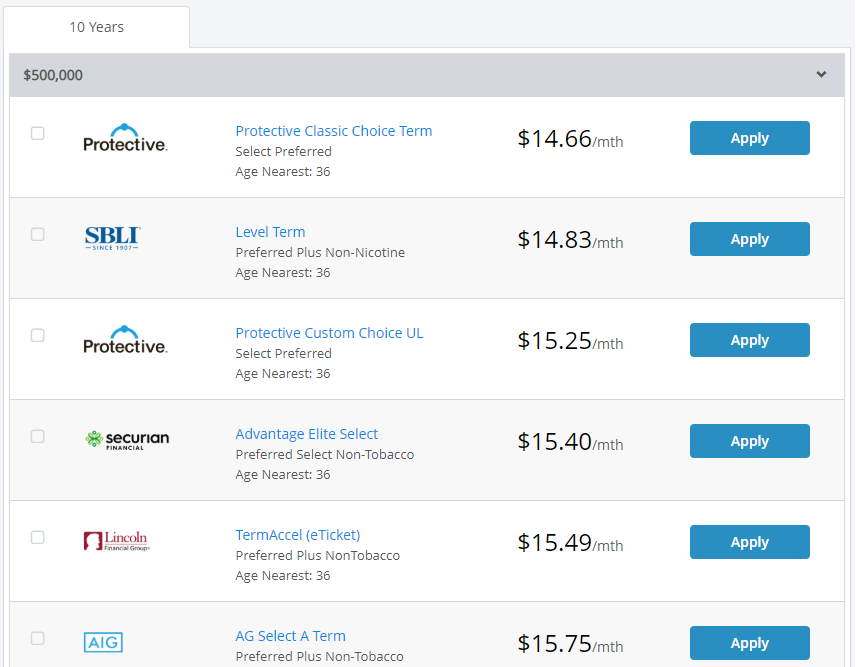

If you have run a quote using our online quote tool, then your results most likely turned up with multiple companies, along with multiple rates ranging from lowest to highest such as the example below.

The rates shown in the above example are actual life insurance rates that have been set by each life insurance company shown on the quote result. You may be wondering how does the life insurance company determine these rates and why is there a difference between each company?

When it comes to life insurance rates, it is uncommon that any two companies will be offering the same price. That is not to say that is isn’t possible, but it doesn’t happen very often.

Rates vary from each company ranging from within a couple of cents, a few dollars or even a couple hundred of dollars. This is one of the many ways that life insurance companies stay competitive with each other.

However, that is not the only factor that determines the overall rates. In other words, life insurance companies don’t assess their prices based on any random number.

Instead, their underwriters work alongside with actuaries to study a significant amount of data and statistics such as mortality and sickness tables based on all age groups. All of this information is compiled and analyzed to determine a set of final rates.

It is essential to understand that rates will vary depending on several factors such as age, gender, health, tobacco and even the type of life insurance coverage you are applying for.

This leads us into the next topic of how much will your life insurance premiums be?

How Much are Life Insurance Premiums?

So at this point, you should have a pretty good understanding of how the life insurance company determines their rates. Now we need to discuss the most important question which is how much will your life insurance premiums be?

The answer to this question is based primarily around a risk classification which is determined through underwriting. There are six primary risk classifications which correspond with a set of rates that have been determined by the life insurance company.

The less of a risk you are to the insurance company having to pay out a possible death claim, the better your life insurance rates will be. There are several factors that go into determining the risk classification.

Here is a list of some of the most common factors that are used to determine risk classification eligibility.

- Age

- Health

- Tobacco Use

- Height & Weight

- Family Health History (Heart & Cancer)

- Driving History

- Alcohol / Drug History

- Hazardous Activities

As we mentioned, the risk classification that you will qualify for will be determined through underwriting which takes place when an application has been submitted for coverage.

The insurance company utilizes several underwriting tools to help determine an applicant’s overall risk to the insurance company.

This is a general list of underwriting tools used to help determine a risk classification. Not all of these will apply for every application.

- Application

- Medical Exam

- Medical Records

- Medical Information Bureau (MIB)

- Prescription Check (Rx)

- Motor Vehicle Report (MVR)

- LexisNexis

Risk classification plays a huge role when it comes to the overall life insurance premium, but it’s only a determining factor. The following are additional factors to take into consideration, as they do have an impact on the premiums.

Type of Life Insurance Plan

As we mentioned earlier, term life insurance is temporary contracts whereas universal life insurance and whole life insurance are permanent contracts.

The longer your life insurance plan is, the higher the chances are for the life insurance company to have to pay out a claim. Therefore a permanent life insurance plan will always result in more substantial premiums than a term life insurance policy.

Although significantly cheaper, term life can be viewed the same way. A longer duration of term life insurance such as a 30 or 40-year contract will have higher life insurance premiums than a 10-year term life insurance contract.

| Name of Coverage | Type of Coverage | Length of Coverage | Cost of Coverage |

|---|---|---|---|

| 10 Year Term | Temporary | 10 Years | $ |

| 15 Year Term | Temporary | 15 Years | $$ |

| 20 Year Term | Temporary | 20 Years | $$$ |

| 25 Year Term | Temporary | 25 Years | $$$$ |

| 30 Year Term | Temporary | 30 Years | $$$$$ |

| 35 Year Term | Temporary | 35 Years | $$$$$$ |

| 40 Year Term | Temporary | 40 Years | $$$$$$$ |

| Universal Life | Permanent | To Age 121 | $$$$$$$$ |

| Whole Life | Permanent | To Age 121 | $$$$$$$$$ |

Amount of Coverage

When it comes to life insurance coverage, you get to choose an amount of coverage that will be left to your beneficiaries. In addition to the type of plan you choose, the overall death benefit amount will have an effect on the life insurance premium.

Larger amounts of coverage will require higher premiums as the life insurance company stands to lose a much more considerable amount of money, compared to the premiums that are being paid for the actual life insurance coverage. Smaller amounts such as $25,000 or less will result in much lower premiums.

IMPORTANT

Purchasing life insurance is one of the greatest ways to financially protect your loved ones from an unexpected passing. When determining an appropriate amount of coverage, it is important to purchase what you can afford while trying your best to make sure that the death benefit is enough to meet all financial needs.

Determining a correct amount of coverage may require the help of an experienced life insurance agent, but there are few general rules of thumb you can follow:

Take Your Dependents into Consideration

The more people that depend on you, like your spouse, children or other family members, the greater the amount of coverage you will most likely need.

Remember DIME

This acronym is helpful if you have no idea what kind of coverage you need.

D = Debt: First, calculate how much debt you have and what kind of final expenses you expect to incur.

I = Income: Then multiply your income by how long you think your dependent will need support.

M = Mortgage: Then, calculate the amount you still need to pay back on your mortgage.

E = Education: Finally, how much is it going to cost for your dependents to complete their education?

Add the numbers and this should provide you with a general idea of the amount of coverage you need.

Multiply Your Income by 10

By far the easiest option, just take your annual income and multiply it by 10.

Obviously, policies that cover a higher number are more expensive. So if you can’t afford your income by ten, could you do it by eight or nine? The idea behind this method is replacing overall annual income to a spouse or loved one for a specific amount of years so that they can maintain the same lifestyle that they’re used to living.

All of these examples are a good starting point for giving you an idea of what to consider when determining an amount of coverage.

How Are Life Insurance Premiums Paid?

The final factor that comes into the overall cost of life insurance premiums is in the way you choose to pay them. There are four standard ways you can make your premium payments.

You can do it monthly which is 12 premium payments over the course of a year. Then there is quarterly which equals four payments over the year. Another option is semi-annually which is two payments in one year. Finally, there is an annual payment, which is the full premium for the entire year.

The monthly premium option is by far the most affordable for many families, but it is actually cheaper to pay your life insurance premiums annually.

Having a longer premium payment, such as monthly, requires additional costs to the life insurance company for things like processing fees and even postage in some cases. Electing to pay a shorter premium duration will result in a small discount.

A good example of seeing the actual discount can be done with the online quote form. Run a life insurance quote using an annual premium. Jot that number down and then run the same quote, but using a monthly payment.

Take the monthly premium payment and multiply that number by 12. Compare your results to the actual annual premium versus the monthly premium x12. You will see that monthly premium over the course of 12 months is actually higher than paying an annual payment.

This will also give you the amount of the discount when paying an annual premium payment. This also works with quarterly and semi-annual methods as well.

Just remember, the shorter the premium duration, the cheaper the premium. Although, do what makes financial sense to you and your family. You can always make changes to the way you pay in later years if you choose to.

Your one-stop online guide for life insurance quotes. Get free quotes now!

Secured with SHA-256 Encryption

What’s the Difference Between a Premium and a Quote?

How accurate are online life insurance quotes?

Throughout this article, we discussed several factors that make up life insurance premiums as well as how the actual life insurance companies determine the rates that they will charge their potential customer.

When obtaining quotes for life insurance online, you may be wondering how accurate they are. You can rest assured, the online quotes or at least the online quotes here at Top Quote Life Insurance are 100% accurate. The rates displayed on our online quote tool are not only provided by the life insurance company’s rate guides but also updated right away when there is a change in pricing.

The biggest thing to keep in mind is that an online life insurance quote is just an idea of what the price can be if you qualify for the risk classification and meet all underwriting requirements set by the insurance company.

Tips and Tricks for an Accurate Life Insurance Quote

You should, absolutely, work with an experienced life insurance agent or agency when you are ready to apply for life insurance coverage. We always recommend working with an independent agency such as ours so that we can offer multiple quotes, as well as several different companies.

One of the biggest benefits to working with an experienced independent life insurance agent is that they should be familiar with multiple life insurance companies and have an excellent understanding on their products, as well as their underwriting niches.

For the client, this eliminates a significant amount of research and ensures a smooth application process with a result of a spot on the premium that matches your initial quote for coverage.

The trick is to be as honest as possible with your life insurance agent. They’re not there to judge you or question your choices – they simply need to know the truest state of your affairs to get you a realistic rate.

Starting the Process – Determining Your Life Insurance Premium

We at Top Quote Life Insurance hope we gave you a very good understanding of life insurance premiums and cleared up any potential confusion or questions you may have had about them.

If you’re in the early stages of shopping for life insurance coverage, by all means, please use our free life insurance quoter to get an idea of some possible premiums.

Don’t forget to reach out to us with any life insurance questions as we are standing by ready to help or assist.

Ready to Compare Life Insurance Rates?

It’s free, fast and super simple.

Looking to compare life insurance prices? We can help. Enter your ZIP code to get free quotes from multiple insurers.

Your one-stop online guide for life insurance quotes. Get free quotes now!

Secured with SHA-256 Encryption

Leslie Kasperowicz

Farmers CSR for 4 Years

Leslie Kasperowicz holds a BA in Social Sciences from the University of Winnipeg. She spent several years as a Farmers Insurance CSR, gaining a solid understanding of insurance products including home, life, auto, and commercial and working directly with insurance customers to understand their needs. She has since used that knowledge in her more than ten years as a writer, largely in the insur...

Farmers CSR for 4 Years

Editorial Guidelines: We are a free online resource for anyone interested in learning more about life insurance. Our goal is to be an objective, third-party resource for everything life insurance-related. We update our site regularly, and all content is reviewed by life insurance experts.